In an increasingly volatile global economy, selecting the right investment vehicle is paramount. As inflation, geopolitical tension, and market disruptions surge, investors frequently pivot between two traditional safe-haven assets: gold and real estate. While gold shines in moments of panic, real estate remains a cornerstone of generational wealth. In this comprehensive analysis, we provide a decisive breakdown—eliminating ambiguity—to help serious investors structure their portfolios with clarity and purpose.

🪙 Gold Investment: Tactical Move, Not a Strategy

Gold has historically acted as a crisis commodity, thriving during periods of global uncertainty, inflation spikes, and currency instability. With central banks globally hoarding gold, the upward trajectory in prices is evident. However, this momentum is often reactionary, not structural.

Key Drivers of Gold Prices

- Monetary policy loosening and declining real interest rates

- Currency depreciation, especially USD weakness

- Geopolitical instability and wars (Ukraine, Middle East)

- Central bank diversification from dollar reserves

Despite its appeal, gold is not a productive asset. It doesn’t generate cash flows. Investors profit only through capital appreciation—a factor heavily dependent on macroeconomics, not value creation.

In 2024, gold offered a 20% return. But is this sustainable, or is it a case of recency bias?

📊 Comparative Overview of Gold and Real Estate

| Feature | Gold | Real Estate |

|---|---|---|

| Liquidity | High (instant sale via digital platforms) | Low (time-intensive sales process) |

| Return Potential (2024) | ~20% | ~10–18% (depending on location/type) |

| Volatility | High in short bursts | Low and stable |

| Income Generation | None | Yes (rental yields: 2–5%) |

| Hedge Against Inflation | Strong | Moderate to Strong |

| Accessibility | Easy (Sovereign Gold Bonds, ETFs, Digital Gold) | Moderate (requires capital, documentation) |

| Leverage Potential | No | Yes (home loans, LTV advantages) |

| Taxation | Indexed capital gains after 3 years | Deductible interest, depreciation, LTCG benefits |

🏘 Real Estate: Engine of Long-Term Wealth and Income

Real estate is more than just an investment; it is a multifaceted asset class offering income, capital gains, and leverage. Its low correlation with equity markets also makes it a portfolio stabilizer.

Key Wealth-Building Mechanisms

- Appreciation: Tier-1 cities in India recorded 8–12% YoY appreciation in 2024.

- Rental Yield: Commercial properties yield 5–8%, while residential yield remains 2–3%.

- Leverage: A ₹50 lakh investment can control assets worth ₹1.5–2 crore via home loans.

- Tax Optimization: Interest on home loans, depreciation, and LTCG exemptions reduce taxable income.

- Behavioural Stickiness: Property is seldom panic-sold. This ‘inertia’ protects investors from impulsive exits.

India’s Real Estate Market: A $10 Trillion Growth Path by 2047

🧠 Investor Psychology: The Perception Trap

Gold often appeals during fear-driven cycles. But long-term investors must resist the trap of emotional allocation. While gold provides liquidity, it doesn’t beat inflation-adjusted returns from real estate in most historical cycles.

Historical Performance Snapshot (India)

| Year | Gold Returns (%) | Real Estate Returns (%) |

|---|---|---|

| 2020 | 27.6 | 3–5 (COVID hit) |

| 2021 | -4.1 | 6–8 |

| 2022 | 12.3 | 9–12 |

| 2023 | 13.7 | 11–14 |

| 2024 | 20.1 | 10–18 (luxury segment) |

While gold offers episodic spikes, real estate offers consistent compounding when location, timing, and project type are optimized.

Also Read: The ‘Coldplay Effect’ in Indian Real Estate: A Deep Dive into Symbolic Consumption and Its Economic Implications

🏗 Real Estate Segments: Where the Smart Money Is Moving

- Luxury Housing: Dominates post-pandemic buying patterns; contributed 50%+ to total sales in H2 2024.

- Grade A Office Spaces: MNC expansion and REIT popularity driving demand.

- Second Homes & Villas: Rising due to hybrid work and aspirational lifestyle shifts.

- Fractional Ownership & Real Estate Crowdfunding: Emerging as digital disruptors allowing small-ticket entry.

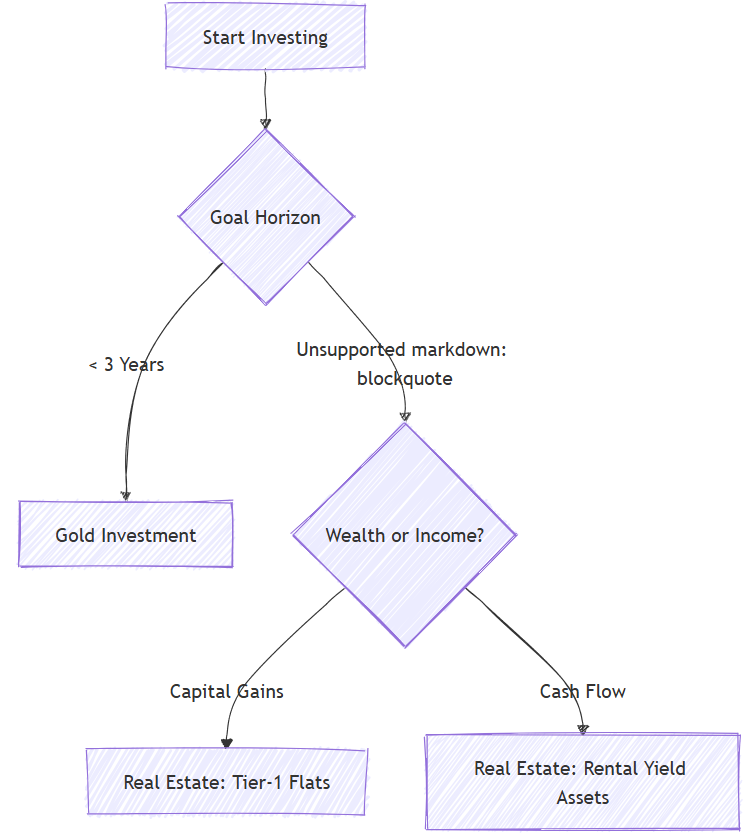

📈 Diagram: Gold vs Real Estate Investment Lifecycle

The BRRRR Investment Strategy-Buy, Rehab, Rent, Refinance, Repeat

📌 Strategic Recommendations

If You Prioritize Liquidity and Short-Term Safety:

- Allocate up to 10–15% in gold via ETFs or sovereign gold bonds.

- Avoid overexposure to gold during bullish rallies.

If You Aim for Long-Term Wealth Creation:

- Invest in rising micro-markets with strong infrastructure pipelines (e.g., Dwarka Expressway, ORR-Hyderabad, Panvel).

- Utilize low home loan rates to maximize leverage.

- Consider REITs for passive income with lower capital thresholds.

RBI’s Consecutive Repo Rate Cut to 6% Triggers Real Estate Revival Across India

If You Seek Diversification:

- Build a barbell portfolio: Real estate for stability and appreciation, gold for crisis protection.

- Maintain dynamic rebalancing, especially post bull-run in gold.

📚 Final Verdict: Real Estate Dominates Long-Term Portfolios

Gold may glitter momentarily, but real estate builds intergenerational wealth. The psychological satisfaction of owning tangible, income-generating assets combined with multiple wealth drivers makes real estate the definitive choice for serious investors.

While both asset classes have merits, real estate offers depth, structure, and scalability—elements absent in gold investing.

In an era where economic uncertainties are the new normal, investment strategies must evolve from emotional reactions to evidence-based asset allocation. Gold serves as a shield. Real estate, however, remains the sword that carves wealth. Choose wisely—and invest with intention.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion