If you live in Ranchi or own property here, chances are you’ve heard about holding tax. But what exactly is it, and why does it matter? Think of holding tax as a small price you pay to keep your city running smoothly—roads, streetlights, sanitation, and all those little things that make urban life bearable. Paying it on time isn’t just a civic duty; it’s also a smart move to avoid fines and penalties.

What is Holding Tax?

Definition and Purpose

Holding tax, sometimes called property tax, is a tax levied by the municipal corporation on residential and commercial properties. Essentially, it’s calculated based on your property’s location, size, and usage. The revenue collected is used for civic maintenance, infrastructure development, and other local projects.

Property Law Alert : SC Redefines Ownership Rules

Importance for Residents and Businesses

From better roads to clean water, the benefits are clear. For businesses, paying holding tax ensures legal compliance and helps maintain property records, which can be crucial for loans or resale. Think of it as investing in your city while also securing your property rights.

Who Needs to Pay Holding Tax in Ranchi?

Residential Property Owners

Anyone owning a house, apartment, or plot in Ranchi must pay holding tax. Even if you’ve recently purchased the property, registering for the tax ensures your property is recognized officially.

Benefits of Living in a Gated Society vs Standalone Apartment Building

Commercial Property Owners

Shopkeepers, office owners, and industrial property holders also fall under the tax bracket. The municipal corporation treats commercial spaces differently when calculating the tax, often based on potential business revenue.

Eligibility Criteria for Holding Tax

Documents Required

To apply, you need to gather a few essential documents. Think of it as assembling your superhero toolkit—each piece is critical.

Property Ownership Proof

Sale deed, allotment letter, or rent agreement (if applicable). This proves you are the rightful owner or occupant.

Identity and Address Proof

Aadhaar card, Voter ID, Passport, or Driver’s License. This ensures the applicant’s authenticity.

Other Supporting Documents

Previous tax receipts (if renewing), NOC from society or builder, or any government-issued certificates related to property.

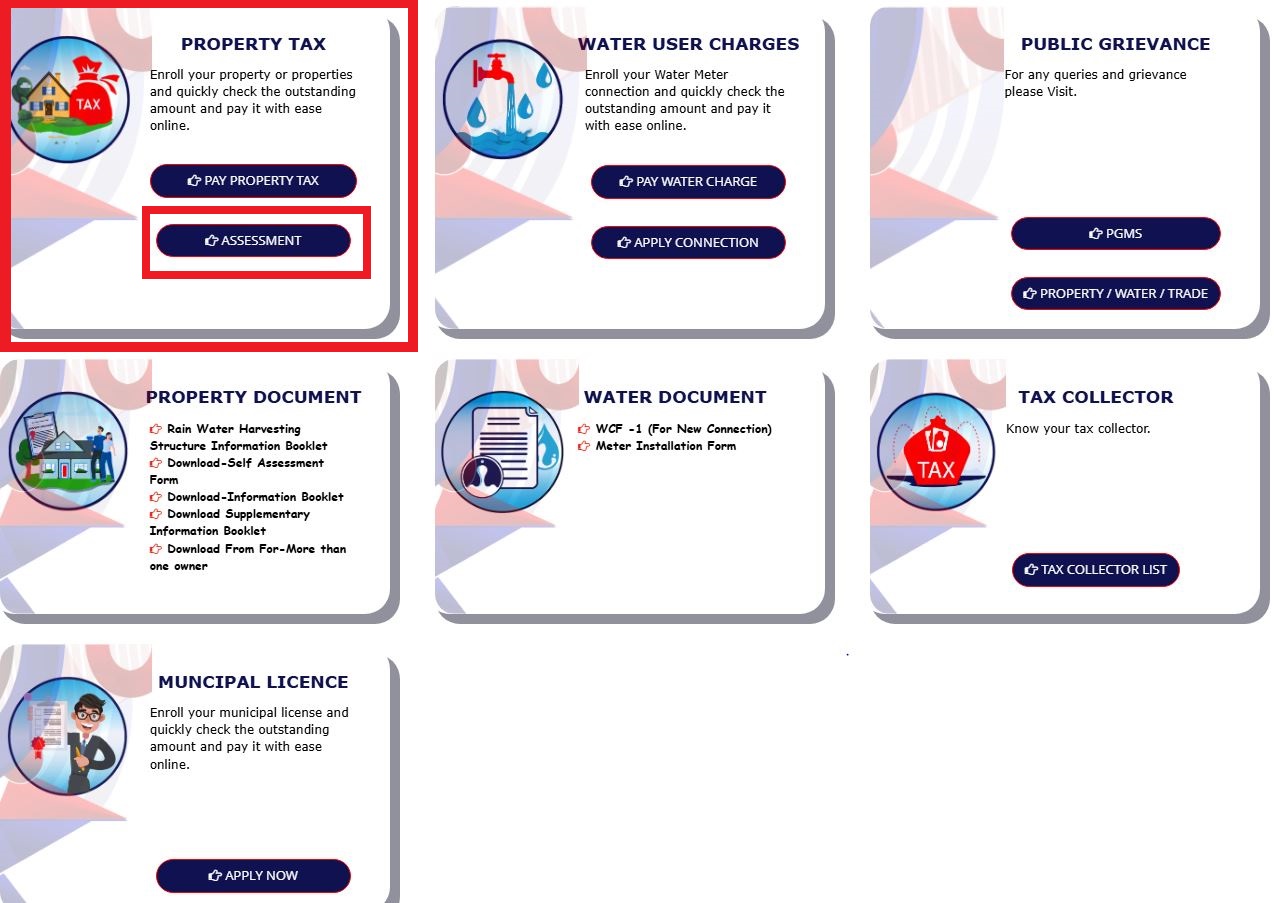

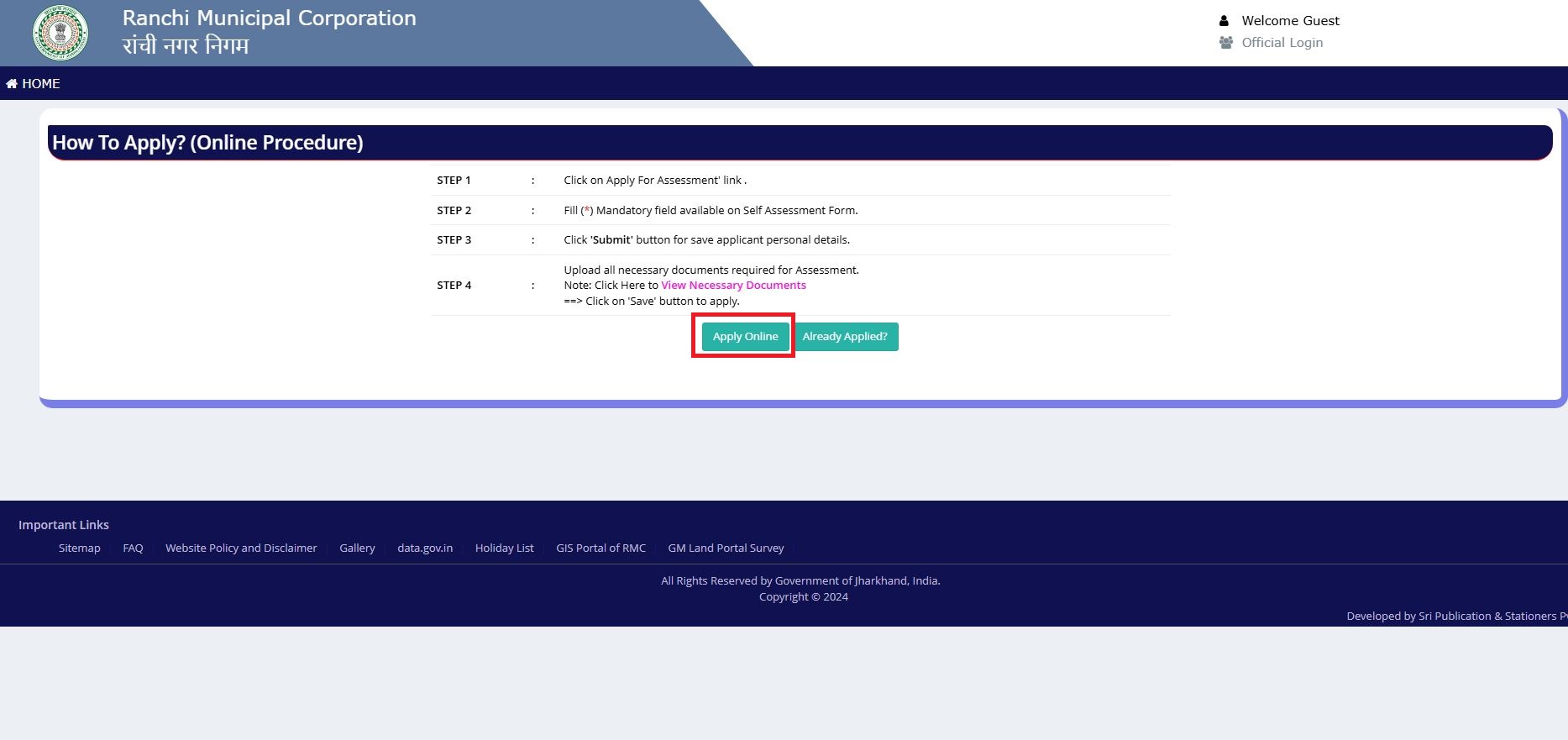

Step-by-Step Guide to Apply for Holding Tax

Step 1: Visit Ranchi Municipal Corporation Website

Open your browser and go https://municipalservices.jharkhand.gov.in/. Look for the “Property Tax” or “Holding Tax” section.

Step 2: Registration/Login

New users should register with valid email and mobile numbers. Existing users can directly log in using credentials. Pro tip: Keep a secure password; this portal stores sensitive data.

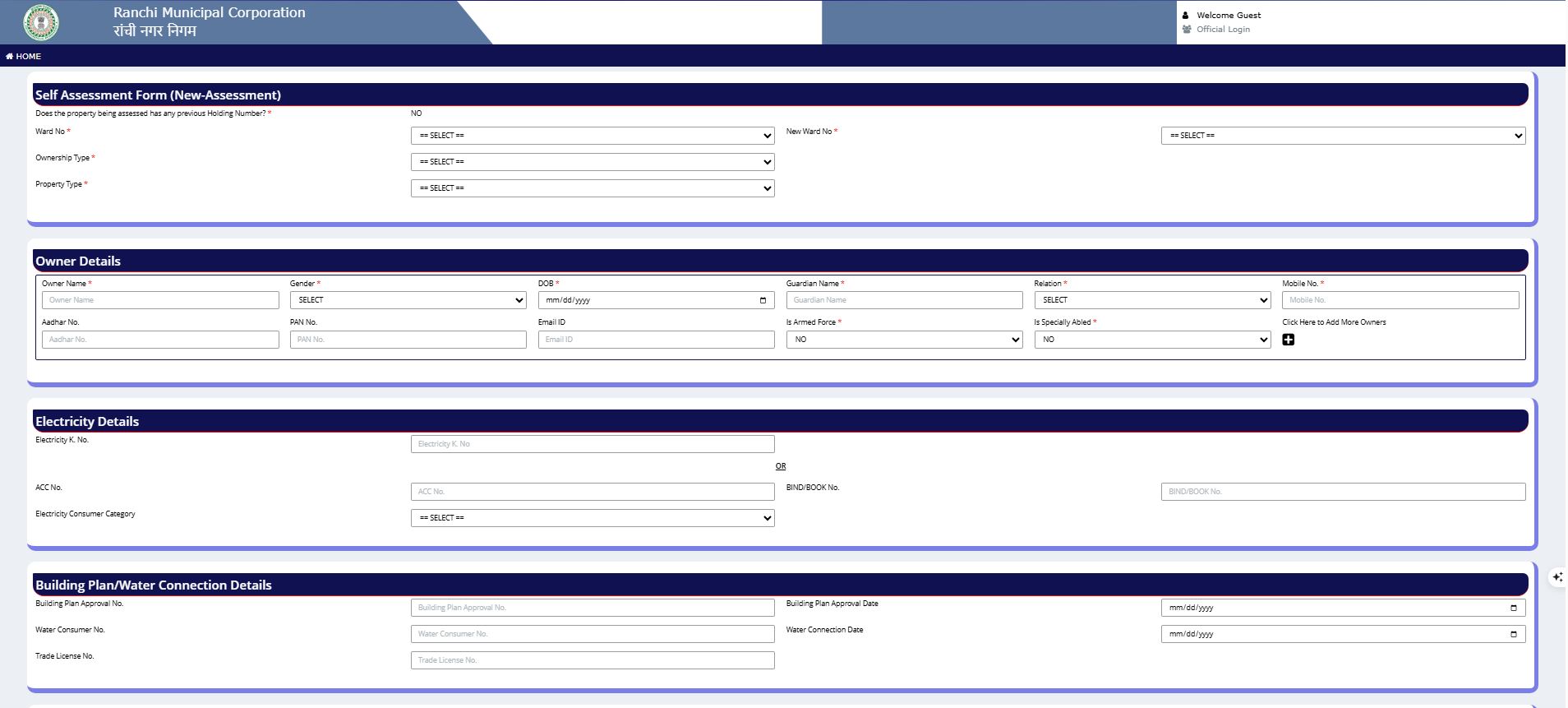

Step 3: Fill the Application Form

Entering Property Details

Input details like property type (residential/commercial), area in square feet, location, and occupancy status. Accuracy here is crucial—mistakes can delay approval.

Step 4: Verification and Payment

Once submitted, the municipal authority verifies your application. You may receive an email or SMS for confirmation. Post-verification, proceed to pay the holding tax.

Modes of Payment for Holding Tax

Online Payment Options

- Net Banking

- UPI (Google Pay, PhonePe, PayTM)

- Credit/Debit Cards

Online payments are fast, convenient, and provide instant receipts.

Offline Payment Methods

- Visit RMC office directly

- Pay at designated banks or collection centers

Though slower, offline payments are useful if you face technical issues.

Common Mistakes to Avoid While Applying

- Entering incorrect property details

- Missing deadlines, which can incur penalties

- Not saving the receipt after payment

Tips to Save on Holding Tax

- Check for rebates for senior citizens or physically challenged owners

- Ensure property assessment is correct; sometimes properties are overvalued

- Pay annually to avoid late fees and enjoy discounts if offered

How to Check Holding Tax Status

After submission, you can check status online by logging into website ‘Already applied’ section. You’ll see whether your application is “Pending,” “Under Verification,” or “Approved.” Keep your receipt handy as proof of payment. If it’s more than 10 working days after application, you can visit the office along with the copy of relevant documents.

Benefits of paying holding (property) tax

1. Legal Ownership Proof

Regularly paying holding tax keeps your property records updated with Ranchi Municipal Corporation (RMC). This acts as proof that you’re the recognized owner or occupier of the property — very useful when selling, mortgaging, or applying for loans.

2. Avoid Penalties & Interest

Late or non-payment attracts penalties and interest. Paying on time saves you money and prevents legal notices or attachment of property in extreme cases.

3. Eligibility for Government Schemes

Some housing or development schemes require proof of tax compliance. Having your holding tax paid makes you eligible for such subsidies, rebates, or building plan approvals.

4. Access to Civic Services

Your tax contributes directly to maintaining roads, streetlights, drainage, sanitation, and waste management in Ranchi. A paid-up property gets priority in services like water/sewerage connections, NOCs, and property mutations.

5. Resale & Transfer Advantage

A clear holding tax record increases the market value of your property. Buyers prefer properties with no outstanding dues, making resale or transfer smoother.

6. Discounts & Rebates

Many municipal corporations, including RMC, offer small discounts for advance or full-year payments. By paying promptly you can actually save money.

7. Peace of Mind

No hanging notices, no surprise bills, and no disputes. You can live or run your business without worrying about compliance issues.

Conclusion

Paying holding tax in Ranchi doesn’t have to be complicated. With proper documents, careful form filling, and timely payment, you can secure your property, avoid penalties, and contribute to the city’s development. Think of it not just as a tax, but as your ticket to a cleaner, safer, and more organized Ranchi. Staying informed and proactive ensures a hassle-free experience, letting you focus on what matters—enjoying your home or running your business with peace of mind.

FAQs About Holding Tax in Ranchi

1. Can I apply for holding tax offline?

Yes, you can visit the RMC office and submit the application along with required documents.

2. Is holding tax applicable on newly purchased property?

Absolutely, it applies from the date you own the property.

3. What happens if I don’t pay holding tax?

Non-payment can lead to penalties, legal notices, or even seizure in extreme cases.

4. Are there any exemptions available?

Senior citizens, freedom fighters, and certain government employees may qualify for partial or full exemptions.

5. Can I pay holding tax in installments?

Yes, RMC allows installment payments for eligible applicants; check the website for details.

Need Help?

Need help evaluating a property or planning your next move in the market?

Reach out to 99 REALTY – your trusted real estate partner for smarter choices.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion