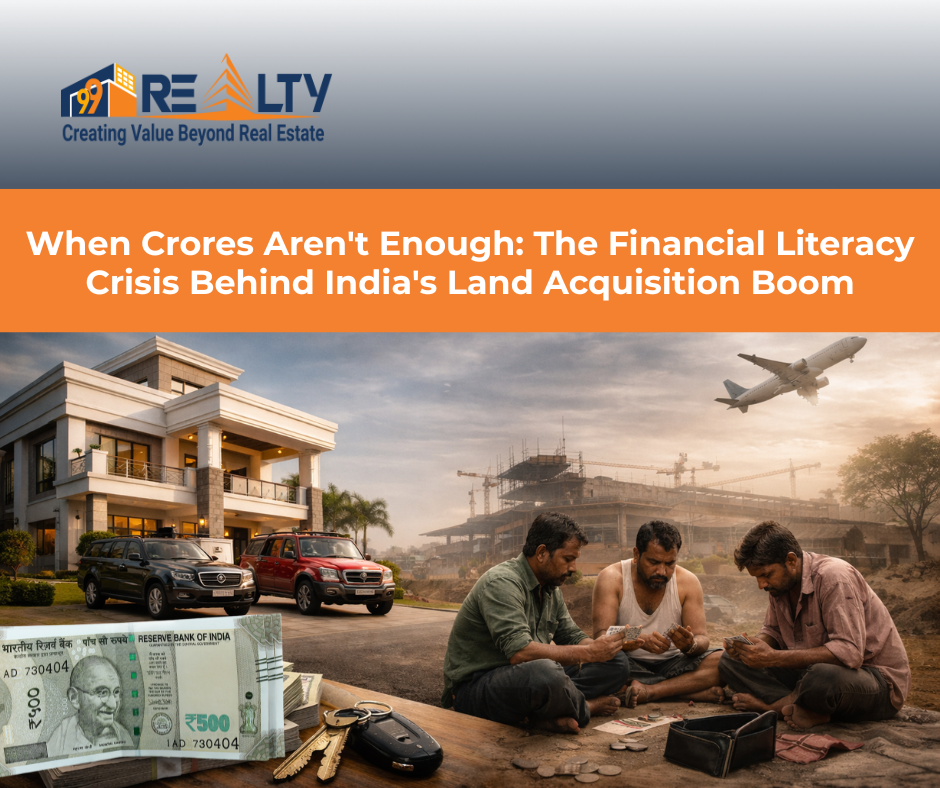

Every few years, India announces a mega infrastructure project. An airport. An expressway. An industrial corridor. Farmland is acquired, compensation is paid, and the news cycle moves on. But what happens to the families left behind — now suddenly holding crores in cash and no land to farm? The answer, as Jewar's development corridor makes painfully clear, is complicated. And it has very little to do...

investment

Budget 2026 is an infrastructure-led budget, anchored by a record capital expenditure of ₹12.22 lakh crore. Through a mix of capex, tax rationalisation, and regulatory nudges—from GST changes to REIT and SM-REIT frameworks—it strengthens the supply and investment side of Indian real estate, while near-term demand outcomes remain contingent on execution, state policies, and financing...

Precious metals have always played a distinct role in investment portfolio. They are not growth assets in the conventional sense, nor are they purely defensive instruments. Instead, gold and silver sit at the intersection of wealth preservation, inflation hedging, and portfolio diversification. As 2026 approaches, investors are once again weighing a familiar question: gold or silver, which offers a...

When you buy a new home, all you can think about is moving in and maybe even hosting a ceremony! However, is moving into a new apartment just about finishing the paperwork, fixing a date and relocating all your stuff? There’s a lot more to it! A home is where you feel secure and live carefree. Before you step in, it is essential to make sure your new home is all set to welcome you. From basic...

For many investors, real estate investment and home loans go hand in hand. Very few people buy property entirely with cash, especially in metro cities where prices run into crores. Used correctly, a home loan can act as a powerful leverage tool, allowing investors to build wealth with limited upfront capital. Used poorly, it can strain cash flows and turn a promising investment into a...

Imagine a monsoon evening in Mumbai: the rain is relentless, water seeps up the street, and the once-secure dream home is swept away. Move to Delhi in May, when the heat is so fierce that even covered balconies offer no respite. These are no longer extraordinary extremes; they are now part of everyday city life. This is where the debate over climate change and real estate really...

Asset allocation is the most important decision an investor makes. More than individual stock selection or market timing, it determines long-term risk, return stability, and capital preservation. Within this framework, real estate occupies a unique position. It is neither a pure growth asset like equities nor a low-risk income instrument like bonds. Instead, it sits in between, offering a blend of income...

Women’s property rights have been a pivotal issue in the fight for gender equality, financial independence and social empowerment in India. Historically, women have encountered both legal obstacles and cultural norms that hindered their ability to inherit, own and manage property on par with men. However, as societal structures evolved, cities expanded, and women’s participation in the workforce...

Periods of heightened market volatility are an unavoidable feature of capital markets. Equity valuations respond rapidly to macroeconomic signals, monetary policy changes, geopolitical developments, and shifts in investor sentiment. While such responsiveness improves price discovery, it also introduces pronounced short-term volatility that can materially impact portfolio stability. Within this context,...

Real estate has long been one of the most trusted asset classes for wealth creation. Yet, despite its strengths, it has always come with structural limitations: high entry costs, low liquidity, long holding periods, and complex transactions. Over the last few years, technology has begun to address some of these challenges. One of the most discussed developments in this space is real estate...