A RERA escrow account is a specialized bank account mandated by the Real Estate (Regulation and Development) Act, 2016 (RERA) in India. Its primary purpose is to ensure that funds collected from homebuyers are used exclusively for the construction and development of the specific real estate project for which they were intended, thereby safeguarding the interests of buyers and promoting transparency in the real estate sector.

Understanding Escrow Accounts

An escrow account is a financial arrangement where a neutral third party holds funds or assets on behalf of two parties involved in a transaction, ensuring that the funds are only released when predetermined conditions are met. This mechanism provides security and builds trust between parties, as the third party manages the funds until all contractual obligations are fulfilled.

Benefits of Escrow Accounts

- Security: Funds are held securely by a neutral third party until all conditions of the transaction are satisfied.

- Trust: Both parties can proceed with the transaction confidently, knowing that the funds will be released only when all contractual obligations are met.

- Compliance: In regulated industries, escrow accounts ensure adherence to legal and contractual requirements, reducing the risk of disputes.

- Financial Planning: For recurring expenses like property taxes and insurance, escrow accounts help in budgeting by distributing large payments over time.

Applications of Escrow Accounts

Escrow accounts are utilized across various industries to facilitate secure transactions:

- Real Estate: In property transactions, escrow accounts hold funds during the period between the buyer’s offer and the closing of the sale, ensuring that both parties meet their contractual obligations before the money is transferred.

- Online Marketplaces: Platforms facilitating the sale of goods or services often use escrow services to hold payments until the buyer confirms receipt and satisfaction with the purchase, protecting against fraud.

- Digital Lending: In peer-to-peer lending, escrow accounts can manage the disbursement of funds and the collection of repayments, ensuring compliance with the agreed terms.

- Construction Projects: Funds are held in escrow to ensure that contractors are paid only upon the completion of specified milestones, promoting adherence to project timelines and quality standards.

Escrow Accounts in Indian Real Estate under RERA

In India, the Real Estate (Regulation and Development) Act, 2016 (RERA) mandates the use of escrow accounts to enhance transparency and protect homebuyers’ interests. Developers are required to deposit 70% of the funds received from buyers into a dedicated escrow account. These funds can only be utilized for expenses related to the specific project, such as construction and land costs, preventing the diversion of funds to other projects and ensuring timely project completion.

This regulation applies to all real estate projects exceeding ₹500 lakhs or involving more than eight apartments, whichever is less. The stringent monitoring of these escrow accounts by regulatory authorities aims to safeguard buyers’ investments and promote accountability within the real estate sector.

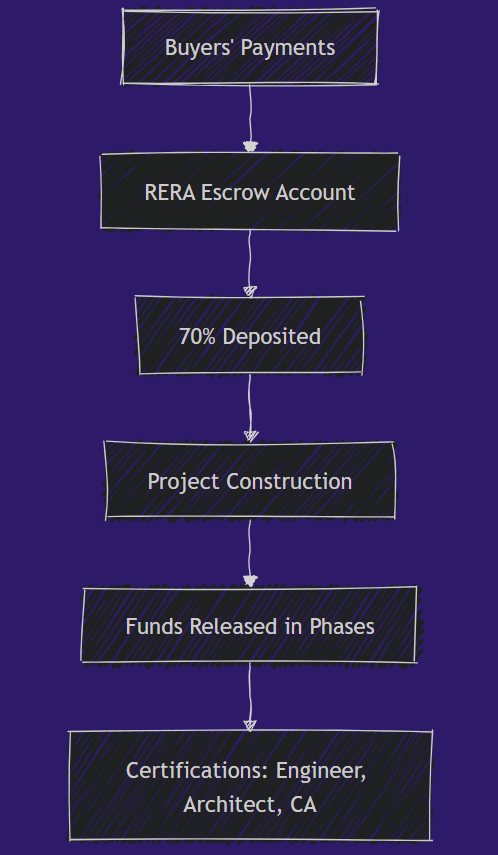

Functioning of a RERA Escrow Account

Under RERA, developers are required to deposit 70% of the funds received from buyers into a designated escrow account maintained with a scheduled bank. These funds can only be withdrawn for expenses related to the construction and land cost of the project, and withdrawals must be certified by an engineer, an architect, and a chartered accountant, confirming that the funds are being used appropriately.

Benefits of RERA Escrow Accounts

- Protection for Homebuyers: By ensuring that buyers’ funds are used exclusively for the specified project, the escrow account minimizes the risk of project delays or non-completion, thereby protecting buyers’ investments.

- Transparency: Developers are mandated to provide regular updates on the status of the escrow account, allowing buyers to monitor the progress of the project and the utilization of their funds.

- Accountability: The requirement for professional certification before fund withdrawal ensures that developers remain accountable for the project’s progress and financial management.

- Investor Confidence: The stringent regulations surrounding escrow accounts enhance overall confidence in the real estate market, encouraging more investment and participation from buyers.

- Timely Project Completion: With funds readily available for construction purposes, the likelihood of project delays due to financial constraints is reduced.

Key Features of RERA Escrow Accounts:

- Mandatory Allocation: Developers are required to deposit at least 70% of the funds received from buyers into a RERA escrow account maintained with a scheduled commercial bank. This stipulation ensures that a significant portion of the buyers’ investments is safeguarded and dedicated solely to project development.

- Restricted Withdrawals: Funds can be withdrawn by the developer only for construction-related expenses and land costs. Each withdrawal requires prior certification from an engineer, an architect, and a chartered accountant, confirming that the funds are being used appropriately and in line with the project’s progress. This restriction prevents the diversion of funds to other projects or purposes, ensuring financial discipline among developers.

- Project-Specific Accounts: A separate escrow account must be maintained for each project. This segregation prevents the diversion of funds from one project to another, ensuring financial discipline and accountability. This practice enhances transparency and accountability.

Regulatory Framework

The Real Estate (Regulation and Development) Act, 2016, provides a comprehensive framework for the operation of RERA escrow accounts, including:

- Fund Allocation: Mandating that 70% of the funds collected from buyers be deposited into the escrow account.

- Restricted Usage: Ensuring that the funds are utilized only for construction and land-related costs of the specific project.

- Withdrawal Conditions: Requiring certifications from a chartered accountant, engineer, and architect before any withdrawal of funds.

- Regular Audits: Mandating periodic audits and reports to ensure compliance and transparency.

Opening a RERA Escrow Account

Developers can open a RERA escrow account with any scheduled bank in India. The process typically involves submitting an application along with the required documentation, paying the necessary fees, and signing the escrow agreement. With the advancement of technology, many developers are opting for digital escrow account services, which offer enhanced convenience and efficiency. To open a RERA escrow account, developers must follow these general steps:

- Project Registration: Register the real estate project under RERA, obtaining the necessary approvals and documentation.

- Bank Selection: Choose a scheduled bank authorized to open RERA escrow accounts.

- Documentation: Submit the required documents, including project details, approvals, and agreements, to the selected bank.

- Account Opening: Complete the bank’s formalities to open the escrow account, ensuring compliance with RERA guidelines.

These provisions are designed to protect buyers and bring greater transparency and accountability to the real estate sector. RERA escrow accounts play a crucial role in enhancing transparency, accountability, and trust in the Indian real estate market. By ensuring that funds collected from buyers are used exclusively for the intended project, they protect homebuyers’ interests and contribute to the sector’s overall health and growth.

Frequently Asked Questions (FAQs):

What is the purpose of a RERA escrow account?

The primary purpose is to ensure that funds collected from buyers are used exclusively for the development of the specific project, preventing misuse and protecting buyers’ interests.

Can developers use the funds in the escrow account for other projects?

No, the funds are strictly meant for the specific project for which they were collected and cannot be diverted elsewhere.

How are withdrawals from the escrow account regulated?

Withdrawals are linked to project milestones and require certifications from professionals like engineers and architects, ensuring funds are used appropriately

What happens if a developer fails to comply with RERA escrow account regulations?

Non-compliance can lead to penalties, project delays, or even cancellation of the project registration under RERA.

Are all real estate projects required to have a RERA escrow account?

Yes, all projects registered under RERA must maintain a separate escrow account for each project to ensure financial transparency and accountability.

How does a RERA escrow account benefit homebuyers?

It ensures that their investments are used solely for the intended project, promotes timely completion, and enhances trust in the developer.

What is the role of banks in managing RERA escrow accounts?

Banks act as custodians of the escrow accounts, overseeing deposits and withdrawals to ensure compliance with RERA regulations.

Can buyers access information about the escrow account?

Yes, RERA mandates transparency, and buyers can request information regarding the funds and their utilization.

Is interest earned on the escrow account funds?

Interest, if any, earned on the escrow account is typically added to the account balance and used for the project’s development.

How does RERA ensure compliance with escrow account provisions?

Through regular audits, mandatory certifications for withdrawals, and stringent penalties for non-compliance.

The implementation of RERA escrow accounts represents a significant step toward reforming the real estate sector in India. By ensuring that a substantial portion of buyers’ funds is dedicated solely to project development, these accounts enhance transparency, protect buyers’ interests, and promote financial discipline among developers. This mechanism not only boosts buyer confidence but also contributes to the overall health and credibility of the real estate industry.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion