Finance Minister Nirmala Sitharaman’s Budget 2024 announcement of reinstating the interest subsidy for middle-class and lower-middle-class homebuyers under the Pradhan Mantri Awas Yojana (PMAY) marks a significant policy shift. This move is poised to bolster the housing sector by making home loans more affordable, especially in an environment of rising interest rates. Here, we explore the intricacies of this reintroduction and its potential impact on the real estate landscape.

PMAY Urban 2.0: A Comprehensive Initiative

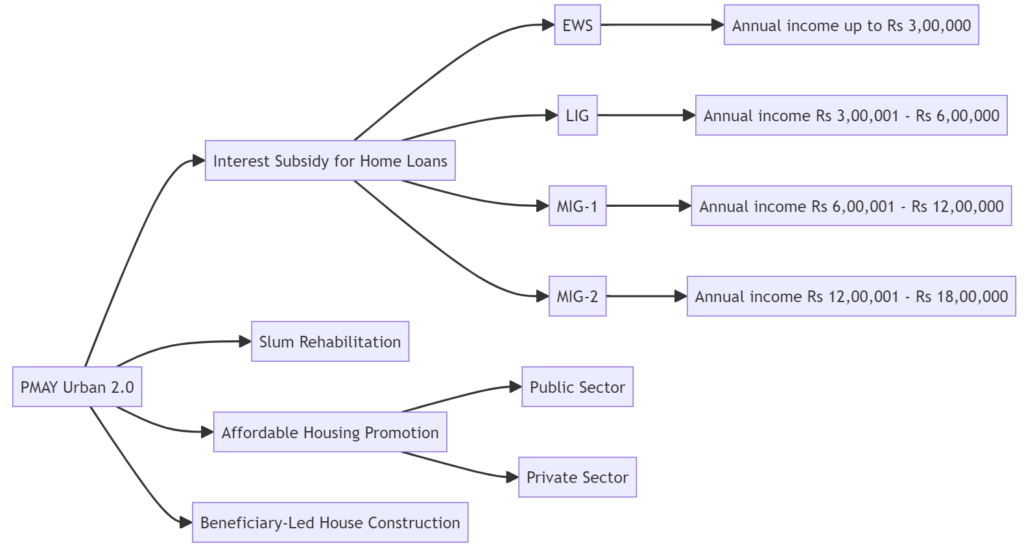

Under the PMAY Urban 2.0, the government aims to address the housing needs of 1 crore urban poor and middle-class families with an investment of Rs 10 lakh crore over the next five years. This includes central assistance of Rs 2.2 lakh crore. The revival of the interest subsidy under the Credit Linked Subsidy Scheme (CLSS) is a critical component of this initiative.

Key Features of PMAY Urban 2.0

- Interest Subsidy for Home Loans: The reintroduction of the interest subsidy under the CLSS aims to provide affordable home loans to eligible beneficiaries. This subsidy reduces the effective interest rate, making homeownership more accessible.

- Target Beneficiaries: The scheme is designed to benefit Economically Weaker Sections (EWS), Low Income Groups (LIG), and Middle Income Groups (MIG) including slum dwellers.

- Housing for All: The overarching goal of PMAY-U is to ensure that every urban family has access to a pucca house with basic amenities by 2024.

Eligibility Criteria for PMAY-U

To avail the benefits under PMAY-U, families must meet specific eligibility criteria:

- Economic Criteria:

- EWS: Households with an annual income up to Rs 3,00,000.

- LIG: Households with an annual income between Rs 3,00,001 and Rs 6,00,000.

- MIG-1: Households with an annual income between Rs 6,00,001 and Rs 12,00,000.

- MIG-2: Households with an annual income between Rs 12,00,001 and Rs 18,00,000.

- Housing Status: Applicants or their family members must not own a pucca house in any part of the country.

- Family Structure: The family must comprise a husband, wife, and unmarried children.

- Residency: The town or city in which the family resides must be covered under the scheme.

- Previous Benefits: Families must not have previously availed benefits from any other government housing schemes.

Sector Reactions to the Reintroduction of Interest Subsidy

Relief Amidst Rising Loan Rates

The revival of the CLSS interest subsidy is widely seen as a positive move amidst the rising home loan rates. According to Jash Panchamia, Promoter of Suraksha Group, “Reintroducing the interest subsidy under the Credit Linked Subsidy Scheme is a welcome move, especially after its discontinuation in 2022. With rising home loan rates, this subsidy will provide much-needed relief for home buyers in the affordable category.”

Need for Comprehensive Measures

However, industry experts also call for additional measures to support the sector. Parth Mehta, CMD of Paradigm Realty, notes, “The reintroduced Credit Linked Subsidy Scheme provides some relief for affordable homebuyers amid rising loan rates, but it’s not enough. Additionally, the 12.5% flat LTCG tax on property sales without indexation benefits is a setback for investors. Comprehensive measures are required to support the sector and facilitate homeownership for all.”

Empowering Women Homebuyers

The Budget 2024-25 also includes provisions to moderate stamp duty charges and lower stamp duties for women homebuyers. Bhavesh Shah, Joint Managing Director of Today Global Developers, highlights this initiative, “In the Budget 2024-25, the move to moderate stamp duty charges and lower stamp duties for women home buyers is a commendable step towards empowering women to invest in real estate and support their home-buying aspirations. Bringing back the interest subsidy under the Credit Linked Subsidy Scheme is a positive step. With home loan rates going up, this subsidy will give a much-needed push for the affordable housing segment.”

Also Read: Budget 2024: Analyzing the Impact on Urban Housing and Real Estate

The Broader Impact of PMAY-U

Slum Rehabilitation

A significant aspect of PMAY-U is the slum rehabilitation initiative, which aims to rehabilitate eligible slum dwellers with the participation of private developers using land as a resource. This not only addresses the housing needs of the urban poor but also contributes to the overall urban development.

Promotion of Affordable Housing

The scheme promotes affordable housing through various partnerships with public and private sectors. Central assistance is provided for EWS houses in projects where at least 35% of the houses are for the EWS category.

Beneficiary-Led House Construction

PMAY-U also supports beneficiary-led individual house construction or enhancement for EWS individuals. This ensures that those in need of individual houses can build or enhance their homes with financial support from the government.

The reintroduction of the interest subsidy under PMAY-U is a crucial step towards making homeownership more affordable for the middle and lower-middle classes. While this move provides significant relief, the real estate sector requires a comprehensive approach to address the challenges posed by rising home loan rates and other financial burdens. The holistic implementation of PMAY Urban 2.0, with its focus on slum rehabilitation, affordable housing promotion, and beneficiary-led construction, is essential for achieving the goal of ‘Housing for All‘ by 2024.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion