Long-term capital gains (LTCG) tax on property is a pivotal aspect for high-net-worth individuals (HNIs) in India, especially when engaging in real estate transactions. Understanding the nuances of LTCG tax regulations is essential for effective financial planning and optimizing tax liabilities.

Recent Developments in LTCG Taxation

In the Union Budget 2024-25, significant amendments were introduced concerning LTCG tax on real estate:

- Tax Rate Adjustment: The LTCG tax rate on property sales was reduced from 20% to 12.5%.

- Indexation Benefit: The indexation benefit, which adjusts the purchase price of an asset for inflation, was initially removed. However, following public feedback, the government allowed taxpayers to choose between:

- A 12.5% tax rate without indexation.

- A 20% tax rate with indexation.

This flexibility enables taxpayers to select the option that best suits their financial circumstances.

Relief for Property Owners: Government Amends Indexation Proposal for Real Estate Taxation

Defining Long-Term Capital Gains on Property

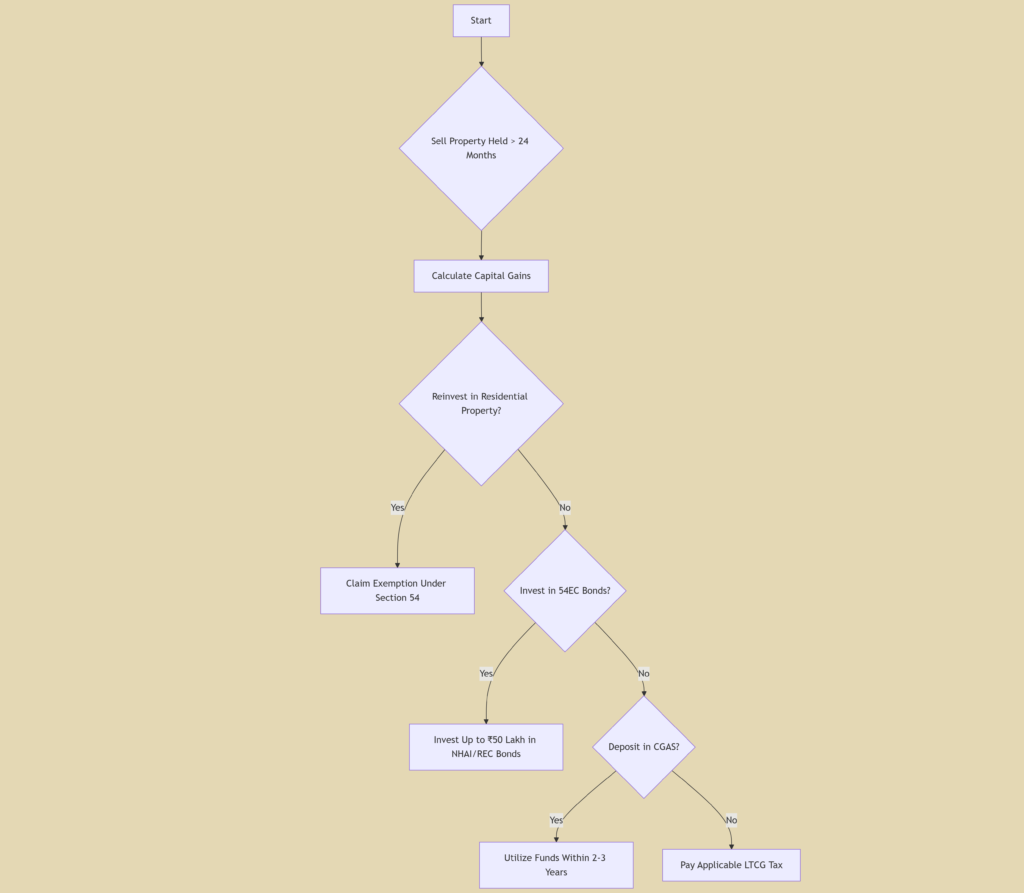

A property held for more than 24 months qualifies as a long-term capital asset. The profit derived from its sale is termed a long-term capital gain. HNIs must be cognizant of the applicable tax rates and available exemptions to manage these gains effectively.

Tax Planning Strategies for HNIs

HNIs can employ several strategies to mitigate LTCG tax liabilities:

1. Reinvestment Under Section 54

Section 54 of the Income Tax Act offers exemptions on LTCG if the proceeds from the sale of a residential property are reinvested in another residential property. Key considerations include:

- Timeline: The new property must be purchased within one year before or two years after the sale, or constructed within three years from the date of sale.

- Exemption Limit: The exemption is proportional to the amount reinvested in the new property.

2. Investment in Capital Gain Bonds Under Section 54EC

Investing in specified bonds can provide tax exemptions:

- Eligible Bonds: Bonds issued by the National Highways Authority of India (NHAI) or the Rural Electrification Corporation (REC).

- Investment Ceiling: Up to ₹50 lakh can be invested within six months of the property sale.

- Lock-in Period: These bonds have a mandatory holding period of five years.

3. Capital Gains Account Scheme (CGAS)

If immediate reinvestment isn’t feasible, depositing the gains into a CGAS allows deferral of tax liability:

- Utilization Period: Funds must be used within two years for purchasing or three years for constructing a new residential property.

4. Diversification into Real Estate Investment Trusts (REITs)

Investing in REITs offers HNIs an opportunity to diversify their portfolios:

- Tax Efficiency: While direct investments in REITs don’t provide LTCG tax exemptions, they can offer regular income distributions with potentially lower tax implications.

- Liquidity: REITs offer greater liquidity compared to direct property investments.

The Ultimate Guide to Real Estate Investment Trusts (REITs)

Role of Developers and Consultants

Real estate developers and consultants play a crucial role in assisting HNIs:

- Structured Payment Plans: Offering flexible payment options to align with the client’s financial planning.

- Advisory Services: Providing insights into tax-efficient investment opportunities and compliance with evolving tax regulations.

- Reinvestment Opportunities: Guiding clients towards projects that qualify for tax exemptions under current laws.

The BRRRR Investment Strategy-Buy, Rehab, Rent, Refinance, Repeat

Diagram: Decision Flow for LTCG Tax Planning

Conclusion

Navigating the complexities of LTCG tax on property requires informed decision-making and strategic planning. By leveraging available exemptions and investment avenues, HNIs can effectively manage their tax liabilities. Collaborating with experienced developers and consultants further enhances the potential for optimized financial outcomes in real estate investments.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion