Embarking on a real estate journey involves more than just finding the perfect property. Understanding the various payment plans is crucial for both developers and buyers. In this blog post, we’ll unravel the meaning behind payment plans, explore different types, and highlight the benefits they bring to the table.

Payment Plans Decoded:

Payment plans are like the roadmap for financial transactions in real estate. They outline how buyers will pay for their property, making the buying process smoother for both parties. Banks also asks for the payment plan to make home loan disbursements. A project/developer can give you the choice of multiple payments plans and some may only give one payment plan, It’s always wise to know the various payment plan, find the best suited payment plan for you and ask your developer if they can offer that plan.

Types of Payment Plans:

Down Payment Plans:

- Meaning: In a down payment plan, (often referred as DP Plan)buyers pay a lump sum upfront, usually a percentage of the property’s total cost which vary from 10-15%. The rest amount can be paid typically within a time frame of 40-60 days. The remaining amount includes property balance, charges from authorities (stamp duty, registration) typically at 5% property value, property tax, maintenance, and society amenity charges (gym, pool, parking).

- Benefits: Quick and straightforward, down payments often come with discounts or perks.

- Risks: Down payment schemes impose significant costs on purchasers in the event of construction and property delivery delays, legal obstacles, etc.. Consequently, reclaiming funds from the developer becomes an arduous task in such circumstances.

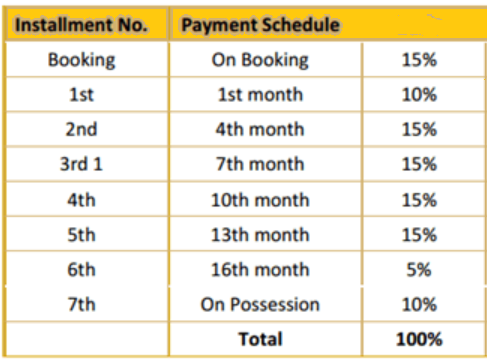

Installment Plans:

- Meaning: Buyers pay in fixed amounts at regular intervals until the total amount is settled. It is also called time linked plan (TLP).

- Benefits: Eases the financial burden, allowing buyers to budget more effectively. No discounts is offered by developer on such plans.

- Risks: The purchaser will be obligated to make the payments even if there is a delay in construction. However, the risk is lower compared to the down payment plan since you pay based on a prearranged schedule rather than the full amount upfront.

Construction-Linked Plan:

- Meaning: Payments in the Construction Linked Plan (CLP) are linked to different stages of construction. As construction progresses, payments are made accordingly. The buyer is not expected to receive a discount with this particular arrangement.

- Benefits: Aligns payments with project milestones, providing transparency and security. Th developer stick to the construction schedule to have a constant cash flow.

- Risks: Construction-Linked plan (CLP) imposes a significant financial burden on the purchaser in the form of interest paid to the bank due to its extended duration. During the construction phase, only interest payments are required, while the repayment of the principal begins after obtaining possession.

Flexi Payment Plans:

- Meaning: Combining aspects of down payment and construction-linked plans, this offers flexibility in payment schedules. This plan requires the home buyer to pay around 50 percent of the total amount by before the start of the construction and is popular for new launches. The rest amount is paid as the construction takes place in different phases.

- Benefits: Balancing upfront costs with periodic payments, providing a middle ground for buyers. Builders often offer some discount on this plan too.

- Risks: If the project halts after booking, especially in the case of new launches it is difficult to get the lump some of money paid. Comparing the flexi payment plan with construction linked plan, you have to pay interest on almost 50% of the amount from the initial phases, making it a bit costlier.

Special Payment Plans:

- Meaning: Special payment plans are designed by the developers to attract more customers to buy a property by offering them split payment options. Buyers often pay around 10-50% of the total cost and the rest can be financed by the bank loan. The special payment plans mainly prevails in ready to possession projects.

- Benefits: You can have less burden of self funding and it offers extended time period even after the possession in some cases.

- Risks: Interest and Principal repayments start immediately and property prices are usually higher if these plans are offered as they are ready possession projects.

Benefits of Thoughtful Payment Plans:

Increased Affordability:

- For Buyers: Flexible payment options make properties more accessible, attracting a broader range of potential buyers.

Enhanced Financial Planning:

- For Buyers: Structured payment plans allow for better budgeting and financial management.

Boosting Sales for Developers:

- For Developers: Attractive payment plans can stimulate sales, making projects more appealing to a diverse audience.

Building Trust:

- For Both: Transparent and fair payment plans build trust between developers and buyers, fostering positive relationships.

Adaptability to Market Trends:

- For Developers: Payment plans can be tailored to align with market demands, ensuring competitiveness.

Payment plans are a pivotal aspect of the real estate transaction puzzle. As a real estate developer, offering thoughtful and flexible plans not only benefits your buyers but also contributes to the success of your projects. By understanding the meaning, exploring various types, and recognizing the benefits, you can navigate the world of payment plans with confidence and contribute to a positive real estate experience for all parties involved. Happy developing!

Subscribe to get updates on our latest posts and market trends.

Join The Discussion