India’s residential real estate market has entered a new era; one defined not just by the number of homes sold, but by the value of those homes.

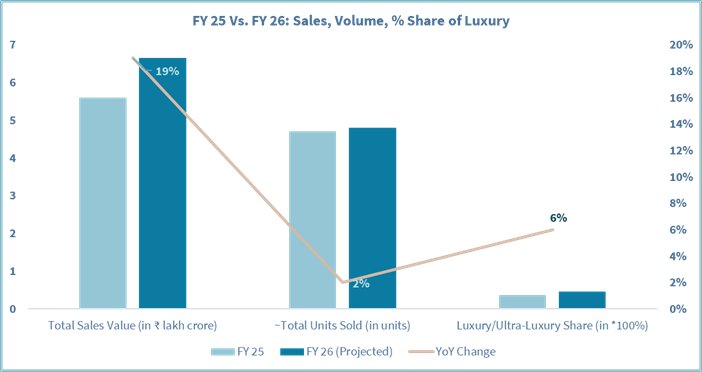

According to latest FY26 projections, the total housing sales value across India’s top seven cities is expected to touch ₹6.65 lakh crore, a sharp 19% jump year-on-year.

However, there’s a twist, the number of units sold (volume) is expected to remain stagnant or see only marginal growth. This signals a crucial shift from quantity to quality, from affordability to aspiration, and from volume to value.

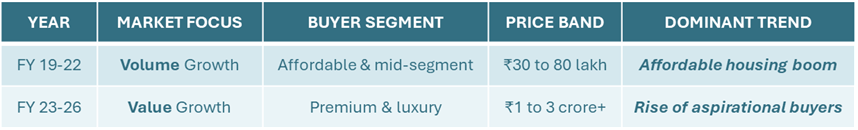

I. Understanding the “volume vs value” shift

For years, India’s housing growth story revolved around volume; developers focused on selling maximum units, catering largely to mid-income and affordable buyers.

But between 2023 and 2025 end, the dynamics changed dramatically.

I.I What’s behind the shift?

• Rising incomes and aspiration among urban professionals and entrepreneurs

• Limited new landsupply in city cores, pushing up per-unit pricing

• Developer consolidation, reducing low-margin affordable projects

• Influx of HNIs, NRIs, and institutional investors into premium housing

II. FY26 the year of value-led growth

So even as the number of homes sold is nearly unchanged, the value of transactions continues to soar, driven by bigger homes, better amenities, and higher price brackets.

Average ticket size in the top 7 cities increased from ₹1.05 crore to ₹1.2 crore between FY25 and FY26 showing a rise of 15%.

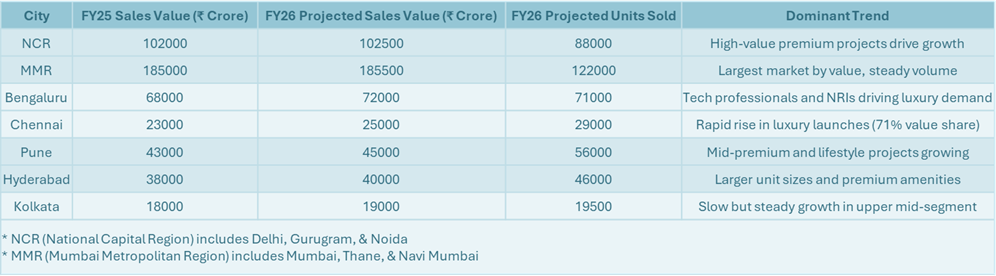

III. City-wise trends (value hotspots of 2025-26)

Based on market reports and industry insights, here’s how India’s top 7 real estate cities are shaping up.

IV. Why are buyers upgrading to premium and luxury homes?

The luxury housing surge isn’t accidental, it’s backed by deep behavioral and economic shifts.

1. Lifestyle upgrades post-COVID: After the pandemic, homebuyers began prioritizing space, design, and amenities over price. 3BHKs and 4BHKs in gated communities have replaced smaller flats in dense neighborhoods.

2. Wealth effect & dual-income households: India is witnessing a rapid rise in millionaires, with 871700 millionaire families in 2025, according to the Mercedes-Benz Hurun India Wealth Report 2025. The rise of dual-income nuclear families and tech-driven entrepreneurship means more disposable income for housing upgrades.

3. Developer strategy: Top builders like DLF, Prestige, Sobha, Lodha, Godrej and Tata Housing have consciously reduced exposure to affordable projects, focusing instead on fewer but high-margin luxury launches.

4. Limited supply & land scarcity: Prime city land has become prohibitively expensive. Developers prefer fewer, high-ticket projects that maximize returns rather than high-volume affordable projects.

5. NRI & investor influence: With the rupee stabilizing and global returns falling, NRI investors are parking more capital in luxury Indian real estate especially in Bengaluru, Gurugram, and Mumbai.

V. The stagnation of volumes. Why is it not a bad news?

At first glance, stagnating unit sales might sound concerning. But flat volumes mask a healthier, more sustainable market.

1. Quality over quantity: Developers are not chasing unsustainable volumes or deep discounts. They’re focusing on financial discipline and timely completion; key for buyer trust.

2. Higher realizations per unit: The average ticket size has grown from ₹80 lakh in FY23 to over ₹1.2 crore in FY25-26, improving profitability and reducing unsold inventory pressure.

3. Improved buyer profile: More end-users and fewer speculative investors mean stable long-term ownership, ensuring better community development and reduced churn.

VI. Impact on affordable and mid-segment housing

The shift to value, however, comes with challenges.

1. Shrinking affordable supply: Affordable housing (<₹50 lakh) now accounts for less than 18% of new supply in metro cities, down from 40% in FY20.

2. Financing challenges: Rising construction costs and higher interest rates have made it tougher for developers to launch sub-₹50 lakh homes profitably.

3. Urban imbalance: The luxury segment’s dominance could widen the housing gap for lower-income groups, especially in Tier-1 cities like Mumbai and Bengaluru.

However, Tier-2 cities like Indore, Lucknow, Coimbatore, and Jaipur are filling that void with affordable and mid-premium projects.

The Future: India’s Real Estate in FY26 and Beyond

The “volume-to-value” shift is not a short-term blip. It’s the new baseline for urban housing.

By FY26, experts expect:

• Luxury homes to form nearly 45 to 50% of total housing value

• Ticket sizes to rise another 10 to 12%, especially in metro markets

• Volume recovery likely only after 2026, as developers expand to Tier-2 cities

In short, India’s housing market is becoming smarter, leaner, and richer in value, mirroring the country’s rising economic and aspirational profile.

FAQs (Frequently Asked Questions)

Why is India’s housing market focusing more on value than volume in FY26?

Because buyers are upgrading to premium homes, driving value growth even with stable volumes.

What does this mean for first-time buyers?

Prices are rising faster than volumes, so early investment is key to avoid affordability pressure.

Is this trend sustainable?

Yes, as long as the demand for larger, lifestyle-oriented homes continues among upper-middle and luxury buyers.

What role do NRIs play in this trend?

NRIs account for nearly 20% of luxury housing demand in metro cities.

Need Help?

Need help evaluating a property or planning your next move in the market?

Reach out to 99 REALTY – your trusted real estate partner for smarter choices.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion