Every few years, India announces a mega infrastructure project. An airport. An expressway. An industrial corridor. Farmland is acquired, compensation is paid, and the news cycle moves on. But what happens to the families left behind — now suddenly holding crores in cash and no land to farm?

The answer, as Jewar’s development corridor makes painfully clear, is complicated. And it has very little to do with how much money was paid.

The Jewar Divide

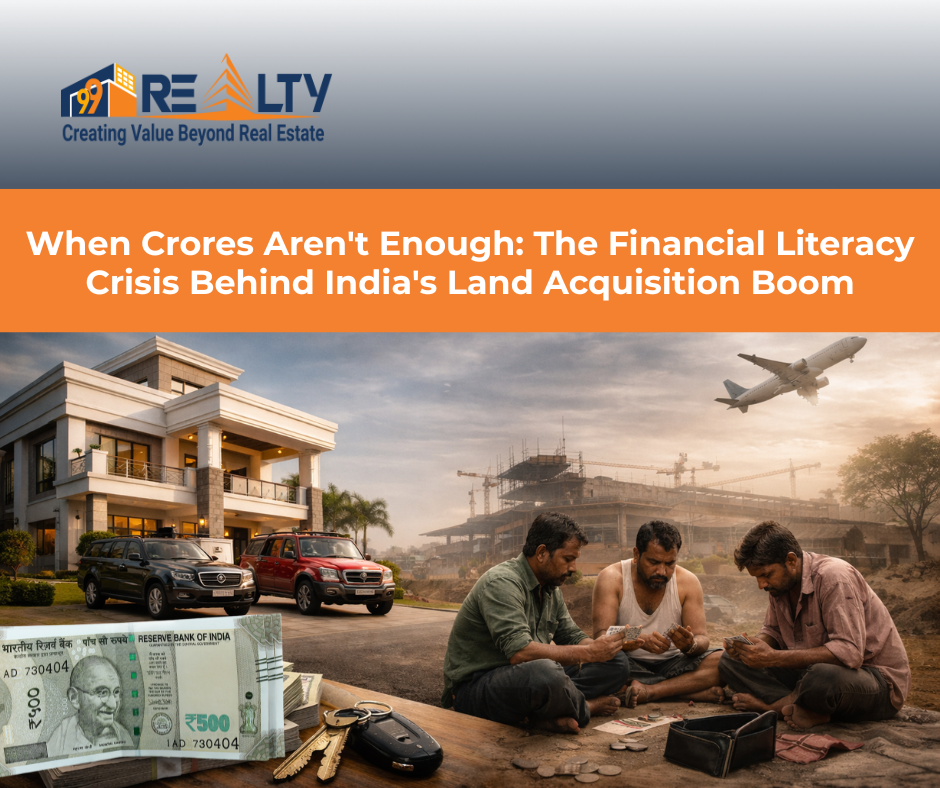

Drive through parts of Jewar’s resettlement colonies today and one can notice a striking contrast.

On one street stands a house that looks like a boutique hotel lobby — marble floors, modular kitchen, two luxury cars parked outside. The owner, once a milk seller, used his land compensation to diversify into a larger dairy operation and small commercial investments. His income didn’t stop when the land went.

A few blocks away, men who received similar compensation sit in a park playing cards. Some are educated — MA degrees, B.Tech graduates. A father of three who left his job after receiving compensation now finds himself without work more than a decade later. There is no business. No recurring income. No fallback plan.

Same policy.

Same cheques.

Radically different outcomes.

Jewar has quietly become a case study in what happens when rural families are handed sudden, substantial wealth — without a framework to manage it.

The Myth of “Not Enough Compensation”

In the first phase of land acquisition in 2018, farmers reportedly received around ₹20 lakh per bigha. By later phases, compensation approached ₹40 lakh per bigha. Some got 3 Cr another got4Cr.

Yet an uncomfortable reality stands out: some families who received lower compensation built sustainable income streams, while others who received significantly more exhausted their funds within few years.

This forces a critical question:

Was the failure about the amount — or the absence of a plan?

Evidence suggests the latter.

Land is not just property. It is a productive asset. It generates seasonal income, food security, rental potential and intergenerational stability. It functions like a slow, reliable well-oiled machine.

Compensation, by contrast, is a lump sum. It arrives instantly. It carries no instruction manual. And when treated like income instead of capital, it evaporates.

The transition from asset-based livelihood to liquidity-based wealth is psychologically disruptive — especially when families have never managed large sums before.

The Real Problem: Wealth Without Financial Literacy

Financial literacy is often misunderstood as education level. Jewar disproves that assumption.

A B.Tech degree does not automatically translate into investment strategy. Formal education does not prepare individuals for sudden capital management.

Financial literacy is a distinct skill set. And in compensation corridors across India, it is often missing.

At its core, it means understanding five essential realities:

1. Wealth Is Not Income

A lump sum is capital. It must be converted into income-generating assets.

Spending it on lifestyle upgrades — larger homes, cars, electronics — permanently reduces earning potential. If wealth is not structured to produce cash flow, it will shrink until it disappears.

2. Inflation Erodes Idle Money

₹1 crore in a low-yield savings account loses purchasing power every year. If money is not invested to outpace inflation, it is quietly depreciating.

Many compensation recipients underestimate this invisible erosion.

3. Diversification Is Protection

Reinvesting the entire payout into a single asset class — especially local real estate — creates concentration risk. Markets fluctuate. Regulatory changes occur. Illiquidity traps capital.

A mix of fixed-income instruments, equity exposure, real estate, and insurance creates resilience.

4. Lifestyle Inflation Is Dangerous

When living standards spike rapidly, expectations reset. Premium becomes normal. Downsizing later becomes psychologically painful — which often leads to borrowing and debt.

Sudden wealth requires emotional discipline as much as financial discipline.

5. Liquidity Buffers Prevent Collapse

Without an emergency fund, even small unexpected expenses force families to liquidate long-term investments prematurely — destroying long-term growth potential.

These concepts sound basic. But without structured guidance, they are rarely implemented.

The RRTS Effect: Connectivity, Growth and Real Estate Wealth

The Cost of “Handling It Yourself”

A common and costly mistake among compensation recipients is assuming that receiving large money automatically means knowing how to manage it.

But managing ₹2 crore is not the same as managing ₹2 lakh.

Tax implications alone can significantly reduce net capital if not planned correctly. In many cases, recipients underestimate capital gains exposure, reinvestment timelines, and structuring options.

More importantly, very few families calculate:

- Sustainable annual withdrawal rates

- Required return to maintain purchasing power

- Education corpus needs

- Retirement horizon

Without these projections, spending becomes reactive instead of strategic.

And reactive spending always wins against long-term discipline.

Why Professional Guidance Changes Outcomes

This is where structured financial planning becomes transformative.

A SEBI-registered investment advisor (RIA) or certified financial planner does not simply recommend products. They create a framework.

A qualified advisor will:

- Assess tax liabilities and optimize post-compensation capital

- Calculate realistic living expenses

- Design a withdrawal strategy that preserves principal

- Allocate funds across risk-adjusted instruments

- Create emergency liquidity buffers

- Establish long-term growth allocation

- Conduct annual reviews to maintain discipline

Most importantly, they provide accountability.

Spending decisions feel different when they are measured against a documented plan.

Fee-only advisors — who charge directly rather than earning commissions — reduce conflicts of interest and align incentives with the client’s long-term stability.

For families navigating land acquisition windfalls, professional guidance should not be optional. It should be the first expense after compensation.

A Simple Framework for Navigating a Large Payout

Whether you have received compensation for land, sold a property, or come into significant money through any other means, the following framework is a responsible starting point:

Step 1 — Stop before you spend. Park the entire amount in a high-yield savings account or liquid mutual fund for at least 60 to 90 days. Do not make any major financial commitments during this period. Allow the initial emotional response to a large sum to settle.

Step 2 — Engage a professional. Use the 60-90 day window to consult a SEBI-registered advisor or certified financial planner. Be transparent about the full amount, your existing liabilities, your family obligations, and your income expectations going forward.

Step 3 — Settle obligations first. Pay off any high-interest debt, address pending tax liabilities, and set aside funds for any near-term, non-negotiable expenses such as children’s education or a medical corpus.

Step 4 — Build a monthly income stream. Work with your advisor to deploy a portion of your corpus into instruments that generate regular, predictable income — such as debt funds, dividend-yielding investments, or rental-generating real estate. The goal is to replicate, and ideally exceed, the monthly income your land previously generated.

Step 5 — Invest the remainder for long-term growth. A diversified equity portfolio, held for ten years or more, historically delivers returns that outpace inflation. This is the wealth-building layer — it is not for short-term spending.

Step 6 — Review annually. Financial planning is not a one-time event. Life circumstances change. Markets shift. An annual review with your advisor keeps the plan relevant and the discipline intact.

Real Estate: Part of the Strategy, Not the Strategy

In land acquisition regions, a common instinct is to reinvest the entire compensation into more property.

Real estate is valuable — but it is illiquid, management-intensive, and geographically concentrated. Overexposure increases vulnerability.

At 99Realty, we view property as one pillar of a diversified wealth architecture — not its entirety.

Commercial assets, residential investments, and land holdings can create long-term security when supported by:

- Liquidity reserves

- Market research

- Legal due diligence

- Balanced asset allocation

Without those safeguards, real estate reinvestment becomes speculation rather than strategy.

The Policy Gap That Families Must Bridge Themselves

The Jewar MLA acknowledged that the government’s role ends at writing the cheque: “The government can provide farmers with appropriate compensation for their land, but how they choose to spend that money was up to them.”

This is the honest reality. Policy in India does not yet mandate financial literacy interventions alongside land acquisition. Block Development Officers and SDOs can run advisory campaigns, but attendance is voluntary and follow-through is inconsistent.

That means the responsibility falls on individuals and families. And recognising that responsibility early — before the money is spent — is the single most important step a compensation recipient can take.

The Uncomfortable Question Jewar Forces Us to Ask

Did compensation fail the farmers of Jewar, or did the absence of financial guidance?

Both, likely. But the more actionable truth is this: the families who treated their compensation as capital — who invested it, diversified it, and planned for income continuity — are the ones who built lasting stability. The families who treated it as liquidity burned through it faster than any policy could have anticipated.

More money would not have changed the outcome for those who lacked a plan. Jewar’s evidence suggests that even doubled compensation, without financial literacy, meets the same fate.

The wealth was real. The opportunity was real. What was missing — for too many — was the knowledge to make it last.

Final Thought

India is building for the future at an unprecedented pace. Airports, expressways, smart cities — each project displacing farming communities that have worked the same land for generations. As this development accelerates, the conversation around land acquisition cannot end at compensation. It must extend to financial preparation, professional guidance, and long-term sustainability planning.

At the individual level, that conversation starts with you. If you or someone you know has received — or is about to receive — a significant land or property payout, the most valuable investment you can make is in professional financial advice. Before the first major purchase. Before the lifestyle expands. Before the crores feel ordinary.

Because money, without a plan, does not last forever.

Disclaimer:

This article is intended for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. Readers are advised to consult a SEBI-registered investment advisor, certified financial planner, or qualified professional before making any financial decisions related to land compensation or investment planning. The views expressed are analytical in nature and based on publicly available information.

Need Help?

Need help evaluating a property or planning your next move in the market?

Reach out to 99 REALTY – your trusted real estate partner for smarter choices.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion