Women’s property rights have been a pivotal issue in the fight for gender equality, financial independence and social empowerment in India. Historically, women have encountered both legal obstacles and cultural norms that hindered their ability to inherit, own and manage property on par with men. However, as societal structures evolved, cities expanded, and women’s participation in the workforce...

Govt Schemes

What if cities could finally see themselves clearly? Not through dusty files, outdated maps, or error-prone manual registers—but through precise, real-time aerial intelligence. That’s exactly what Bhilai is attempting by teaming up with IIT Bhilai for a drone-based property survey. This initiative isn’t just about flying drones over rooftops; it’s about reshaping how cities govern land,...

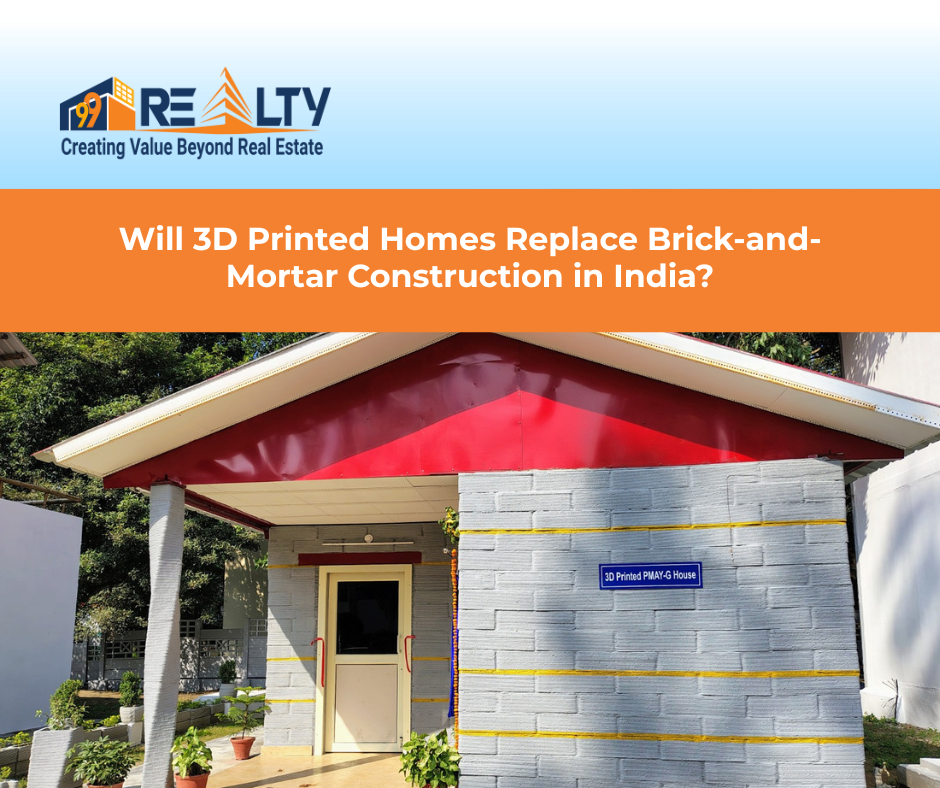

Imagine a house being “drawn” into existence, layer by layer — as if a giant robotic cake-decorator were piping not frosting, but concrete walls. That’s 3D concrete printing in simple terms. And in India, this technology has transitioned from experimental curiosity to practical implementation at remarkable speed. It positioned 3D-printing as a strategic tool for PMAY’s mission of creating safe,...

Imagine managing thousands of government properties—residential quarters, guest houses, and event venues—across India through a single click. Sounds futuristic? That’s exactly what e-Sampada brings to the table. This initiative by the Ministry of Housing and Urban Affairs (MoHUA) has revolutionized how public estates are allotted, managed, and utilized across the nation. Understanding the Concept...

The real estate market has long been a reliable avenue for building wealth, and in 2025, the landscape is evolving at an unprecedented rate. With new market trends, advanced technologies, and changing buyer preferences, investors need to rethink their strategies in order to maximize real estate returns. In India, the sector is undergoing a transformative phase, driven by rapid urbanization,...

When the Smart Cities Mission (SCM) was launched in 2015, it carried the promise of a new India — one that was efficient, sustainable, digitally empowered, and globally competitive. 100 cities were chosen to be the torchbearers of this urban revolution. A decade later, in 2025, it’s time to ask: Have India’s Smart Cities truly become smart — or are they just smarter versions of the old...

Buying a home in India is more than just a financial decision — it’s an emotional milestone. Yet, soaring construction costs and multiple layers of taxation have kept many potential buyers on the sidelines. This September, the government announced a major GST cut on key construction materials, and the move is already being hailed by CREDAI (Confederation of Real Estate Developers’ Associations of...

Imagine this: you’ve invested your life savings—or taken a big home loan—to buy your dream home. You’re paying EMIs. You’ve moved out of your parents’ place. But the construction drags, delays pile up, maybe it’s even stalled. It’s a nightmare. Sadly, this is the reality for many homebuyers in India, caught in stalled real estate projects—promises made, payments done, but delivery...

If you live in Ranchi or own property here, chances are you’ve heard about holding tax. But what exactly is it, and why does it matter? Think of holding tax as a small price you pay to keep your city running smoothly—roads, streetlights, sanitation, and all those little things that make urban life bearable. Paying it on time isn’t just a civic duty; it’s also a smart move to avoid fines and...

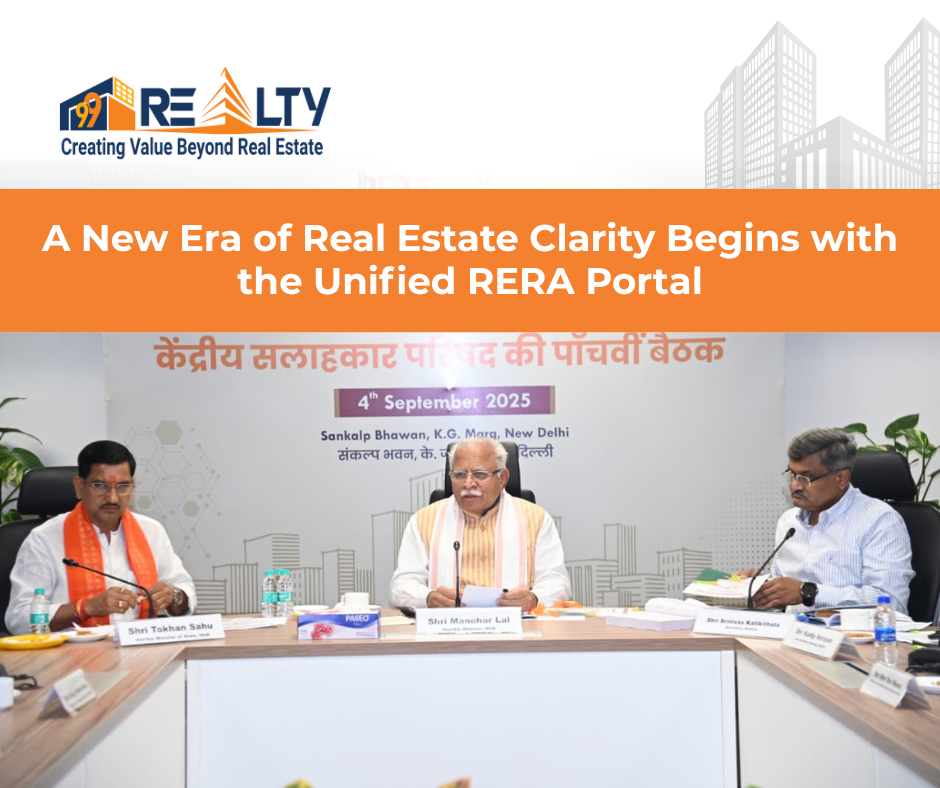

Picture this: you’re a first-time homebuyer sitting at your dining table at 10 p.m., laptop open, tabs everywhere. One state RERA site shows a half-updated list, another times out, a third hides approvals under five clicks. Frustrating, right?Now imagine clicking one link and watching a clean, unified dashboard unfold before you. Every project in every state at your fingertips. That’s the promise of...