Residential real estate is one of the most capital-intensive sectors in the economy, and financing remains a critical factor in its growth. Among the various funding mechanisms, debt financing plays a pivotal role, enabling developers and homebuyers alike to achieve scale and affordability. But what exactly is debt financing, and how does it shape the housing market?

How to Improve Your Credit Score Before Buying a House

Let’s deep dive into how debt fuels the growth of residential real estate, the current trends, the risks involved, and why it’s both a boon and a challenge for the sector.

I. What is debt financing?

Debt financing refers to borrowing money to fund real estate operations. It can either be building projects or buying the property. This can come in several forms:

• Home loans or mortgages for individual buyers

• Project loans for builders and developers

• Structured debt instruments like Non-Convertible Debentures (NCDs)

• Bank credit or NBFC funding

In return for the borrowed funds, the borrower pays interest and repays the principal over a stipulated tenure. Unlike equity financing, the borrower retains full ownership of the property but bears the debt liability.

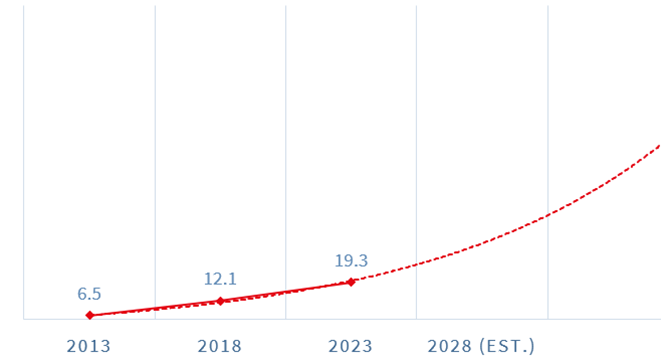

Figure 1. In the past decade, home loan disbursals in India have grown at a CAGR of over 10%, indicating a surge in debt-financed homeownership.

II. Debt instruments

• Home Loans a for Individual Buyers a to Purchase Real Estate Asset

• Construction Loans a for Developers & Builders a for construction funding

• Lease Rental a for Discounting Developers à to Raise funds against rental inflows

• NCDs or Bonds Real Estate Firms a for Large Project Funding

• Bank Credit Lines a for Builders à Short-Term Working Capital Needs

III. Why Is Debt Financing Critical in Residential Real Estate?

• Enables Affordability: High property prices make outright purchase difficult. Debt spreads the cost over time, improving affordability.

• Accelerates Development: For developers, debt ensures steady cash flow during project execution, avoiding construction delays.

• Fuels Housing Demand: Access to affordable credit boosts demand. For example, a 1% fall in mortgage rates can increase housing affordability by nearly 7%.

• Economic Multiplier Effect: Every ₹1 million spent on home construction generates ₹2.84 million of GDP, backed primarily by debt-led investments.

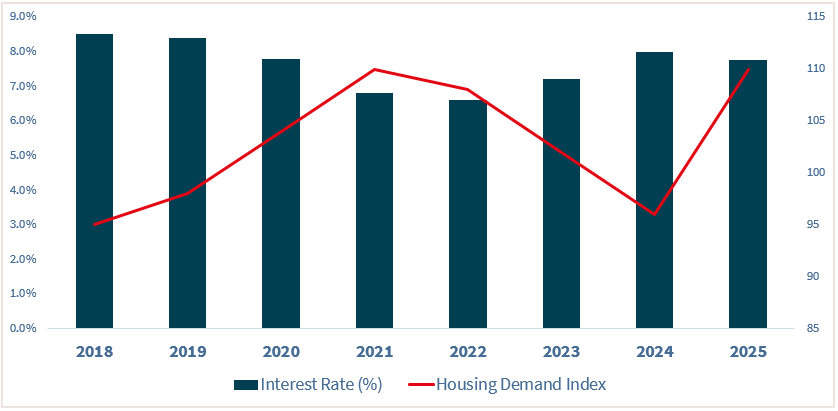

Figure 2. Correlation between interest rates and housing demand index. In the recent times, it is observed that a softening interest rate is boosting the housing demand.

The RBI policy rate (repo rate) is trending down that results in softening of interest rates across industries including home loan rates and lending rates for developers. This increases the affordability of home buyers and other stakeholders.

IV. Challenges of Debt Financing in Real Estate

• Rising NPAs: Over-leveraging by builders and delays in delivery have led to a rise in Non-Performing Assets in the past. As per RBI, real estate NPAs stood at 7.6% in FY2022. However, the value of NPAs have significantly reduced indicating an improved recovery rate.

• Liquidity Crunch in NBFCs: After the IL&FS crisis in 2018, NBFCs faced a credit freeze, stalling project loans across India.

• Overdependence on Debt: Many developers operate with Debt-to-Equity ratios as high as 2.5:1, making them vulnerable to rate hikes or market slowdowns.

V. Government & Regulatory Push

Steps taken by government for better economic situations:

• PMAY Subsidies for low-income homebuyers, reducing reliance on high-interest loans.

• RERA regulations, ensuring transparent fund use and penalizing delays.

• Affordable Housing Funds at concessional rates.

VI. Outlook for 2025 and Beyond

With interest rates stabilizing and demand from Tier 2 and Tier 3 cities growing, debt financing will remain a key enabler of residential real estate. However, investors and homebuyers must balance leverage with caution.

Why Tier 2 and Tier 3 Cities Are the New Investment Frontiers

Sustainable debt practices and regulatory discipline are the key to ensuring real estate continues to thrive without triggering systemic risks.

Debt financing, when used wisely, is a powerful tool to drive home ownership and expand urban infrastructure. It empowers families to own homes and allows developers to build them — but like any tool, it demands discipline, transparency, and regulation.

Disclaimer: The information provided in this article is for general educational and informational purposes only. It should not be considered financial, investment, or legal advice. Readers are encouraged to consult with qualified financial advisors, real estate professionals, or lending institutions before making any borrowing or investment decisions. 99 Realty does not promote or endorse any specific financial product or institution.

Need Help?

Need help evaluating a property or planning your next move in the market?

Reach out to 99 REALTY – your trusted real estate partner for smarter choices.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion