Every home buyer or investor in India faces a common challenge, understanding the technical terms that flood every brochure, sale deed, or bank document. Terms like Occupancy Certificate, RERA carpet area, stamp duty, encumbrance certificate, or FSI often sound intimidating, but they are crucial. Each one influences the legality, livability, and long-term profitability of your purchase. In a 2025 market where transparency, digitization, and buyer protection have become non-negotiable, knowing these terms means more power in your hands.

Legal & approval jargons: The foundation of a valid property

Occupancy Certificate (OC)

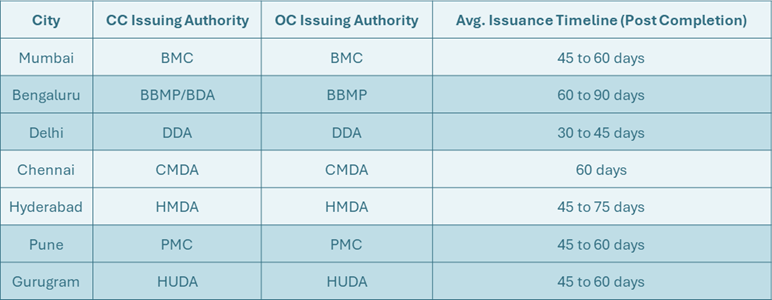

The Occupancy Certificate is the final approval from the local municipal authority certifying that the building is safe and fit.

• Why does it matter? Without an OC, a property is technically illegal for occupation. Banks can refuse home loans, and local utilities may not provide water/electricity connections.

• Issued by: Local municipal corporation or urban development authority.

• Issued after: The builder completes construction as per approved plans and obtains the Completion Certificate.

Buyers Can Now Claim Refunds For Occupancy Certificate Delays

Completion Certificate (CC)

A Completion Certificate verifies that the project is built in compliance with sanctioned plans, building codes, and FSI regulations.

• Builders must first obtain CC → then OC.

• Missing CC can signal unauthorized construction or deviations.

Key Difference:

• CC = Structural and regulatory compliance

• OC = Fitness for occupancy

Fig 1. OC and CC timelines across cities

RERA Registration Number

Under the Real Estate (Regulation and Development) Act, 2016, every project must register with RERA before marketing or selling units. You can verify the land title and approvals, carpet area details, construction timelines, and developer’s litigation history.

Encumbrance Certificate (EC)

An Encumbrance Certificate ensures the property is free from legal or financial liabilities. It lists all transactions, sales, mortgages, or leases, linked to the property.

• Why is it vital? Without a clear EC, ownership may be disputed, or the property could be under loan collateral.

• Where to obtain? Sub-registrar’s office or online (e.g., Kaveri portal for Karnataka).

Title Deed

The legal proof of ownership. Always ensure the title is clear and marketable, i.e., no ongoing disputes, multiple claims, or unregistered transfers.

A “clouded” title can make resale or bank financing nearly impossible.

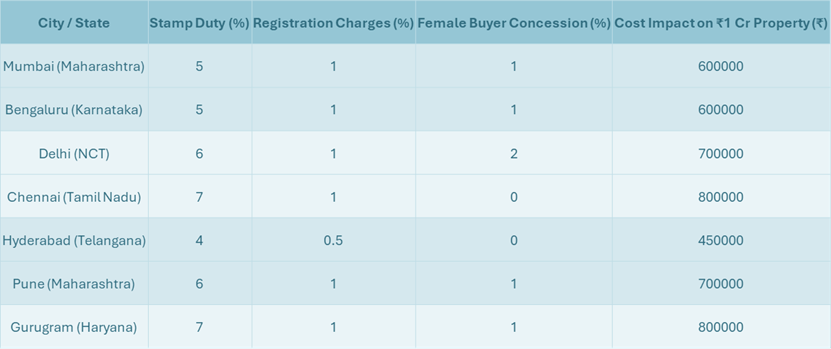

“Stamp Duty & Registration” charges across major cities (2025 update)

Stamp duty and registration fees are mandatory state-imposed charges for validating property ownership.

Fig 2. Stamp duty-registration charges across state

Transaction & documentation terminologies

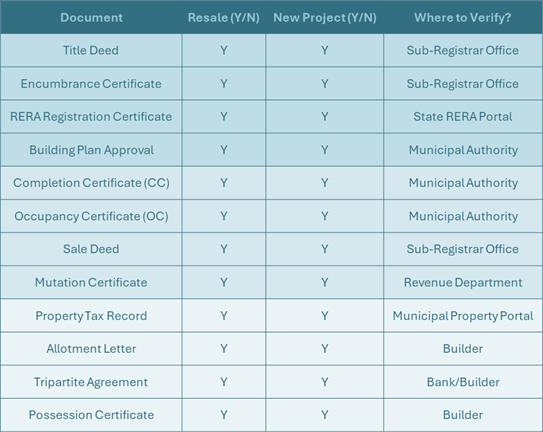

Buying property in India involves a series of legal and financial documents. Understanding these can help you avoid fraud and paperwork delays.

Agreement to Sell (ATS)

A pre-sale agreement outlining terms of purchase, payment schedule, possession date, and penalty clauses. It precedes the Sale Deed and is legally binding once signed.

Understanding the Difference Between Sale Agreement and Sale Deed

Sale Deed

The final transfer document of ownership between seller and buyer. Registered at the Sub-Registrar’s office with stamp duty and registration payment proofs.

Allotment Letter

Given by developers upon booking a unit; mentions flat number, price, and terms. Required for loan processing.

Possession Certificate

Issued when the buyer takes physical possession of the property. Combined with OC, it becomes your legal right of occupancy.

Mutation Certificate

Official record of ownership transfer in municipal records. Necessary for property tax updates.

Property Tax Record (Khata / PID / Assessment Number)

Municipal registration of your property to assess tax liability. Cities like Bengaluru (BBMP Khata) and Delhi (MCD Property ID) have digital portals for updates.

Indemnity Bond

A legal assurance from the seller or developer protecting you against undisclosed legal issues or future claims on the property.

Power of Attorney (PoA)

Allows one person to legally act on another’s behalf in property transactions now heavily monitored to curb misuse. Only notarized and registered PoAs are valid.

Tripartite Agreement

Executed among buyer, builder, and lender when a home loan is availed for an under-construction project; ensures rights of all three parties.

Urban planning & approval terminologies

The character and growth potential of any residential area depend on urban planning parameters and development control regulations.

FSI / FAR (Floor Space Index / Floor Area Ratio)

FSI = Total Built-up Area ÷ Plot Area

Higher FSI means denser development; lower FSI = better open spaces.

For example: In Bengaluru, FSI ranges from 1.75 in outer zones to 3.25 in CBDs.

Setbacks

Mandatory open spaces around the building ensuring ventilation and safety. Non-compliance can lead to penalties or demolition notices.

Zoning & land-use classification

Urban land is classified as residential, commercial, mixed-use, or institutional. Before buying, confirm your project lies in a residential-approved zone (via BDA, HMDA, or CMDA master plans).

Development Plan (DP) & master plan

City-level blueprint dictating land usage, FSI, road width, and civic infrastructure.

For Example: Bengaluru’s Revised Master Plan 2031 or Mumbai’s DP2034 influences long-term appreciation.

Change of Land Use (CLU)

A legal permission to convert agricultural or industrial land into residential use.

Transfer of Development Rights (TDR)

Allows landowners to sell unused FSI to another developer promoting balanced urban density.

Environmental Clearance (EC)

Mandatory for projects over 20,000 sq. m. under MoEFCC rules. Ensures compliance with pollution, sewage, and green norms.

Emerging & digital terminologies in 2025

The real estate ecosystem in 2025 is rapidly digitizing. Understanding the new-age terms helps both investors and millennial buyers.

Fractional ownership

Allows multiple investors to co-own high-value assets like luxury homes or second villas. Platforms use SPVs (Special Purpose Vehicles) for transparent ownership.

Expected CAGR (2024-30): 12 to 15% in India’s luxury property segment

Blockchain land registry

States like Telangana and Maharashtra have initiated blockchain-based property ledgers, ensuring tamper-proof ownership history.

Digital e-Stamping & e-Registration

Replaces physical stamp papers.

• Reduces fraud risk

• Enables instant registration

• Integrated with Aadhaar and PAN verification

Proptech

Short for Property Technology, it includes AI-based valuation tools, virtual tours, and predictive analytics for investment returns.

For examples: JLL’s “AI Valuer”, Magicbricks’ “Price Index 2.0”.

Green building certification

Buildings certified under IGBC, LEED, or GRIHA for energy efficiency. Now incentivized with property tax rebates in Bengaluru and Pune.

Smart home

Residences equipped with IoT-based systems controlling lighting, security, and temperature. Increasing standard in 2025 mid-luxury projects.

Co-living and hybrid living spaces

Modern rental models offering fully managed residences for professionals with flexible lease and digital management.

REITs (Real Estate Investment Trusts)

Earlier limited to commercial assets, Residential REITs are now emerging in metros enabling fractional rental income opportunities.

Approval & construction process terminologies

Understanding what goes into the development approval process helps you verify authenticity.

Document checklist for buyers & investors (2025)

Before finalizing your purchase, ensure you verify and collect the following:

Understanding the technical and legal language of real estate gives you the same power developers and lawyers have. OC, CC, stamp duty, title deeds, zoning, each affects your home’s legality, safety, and resale potential. In 2025, where regulation and digitization dominate, your best investment strategy is informed decision-making.

Need Help?

Need help evaluating a property or planning your next move in the market?

Reach out to 99 REALTY – your trusted real estate partner for smarter choices.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion