In 2024, India’s financial markets experienced a remarkable escalation in Qualified Institutional Placements (QIPs), achieving record-breaking fundraising levels. The real estate sector emerged as a significant beneficiary, reflecting robust institutional confidence in the nation’s economic resilience.

What is a Qualified Institutional Placement (QIP)?

In the dynamic landscape of corporate finance, Qualified Institutional Placements (QIPs) have emerged as a pivotal mechanism for listed companies to raise capital efficiently. This article delves into the essence of QIPs, their operational framework, and the factors contributing to their increasing adoption in recent years.

A Qualified Institutional Placement is a capital-raising tool that allows publicly listed companies to issue equity shares, fully or partly convertible debentures, or any securities other than warrants, which are convertible to equity shares, to Qualified Institutional Buyers (QIBs). This method enables companies to access funds without undergoing the extensive regulatory procedures typically associated with public offerings.

The Securities and Exchange Board of India (SEBI) introduced QIPs in 2006 to reduce the reliance of Indian companies on foreign capital through instruments like American Depository Receipts (ADRs) and Global Depository Receipts (GDRs). By facilitating easier access to domestic capital, QIPs have become a preferred route for fundraising among Indian corporates.

Why Are QIPs Gaining Popularity?

Several factors contribute to the growing preference for QIPs among companies:

- Regulatory Efficiency: QIPs offer a streamlined process with fewer regulatory hurdles compared to traditional public offerings. The reduced compliance requirements make it a more straightforward and less time-consuming option for companies seeking to raise capital.

- Cost-Effectiveness: By bypassing the extensive procedures of public issues, companies save on various costs, including underwriting and marketing expenses. This cost efficiency makes QIPs an attractive option for many firms.

- Market Conditions: Favorable market conditions, characterized by robust liquidity and investor interest, have made it conducive for companies to opt for QIPs. The ability to tap into the market swiftly allows firms to capitalize on favorable market sentiments.

- Strategic Financial Planning: Companies leverage QIPs to fund growth initiatives, reduce debt, and pursue strategic projects such as capacity expansion, acquisitions, and technological upgrades. This strategic utilization of funds aligns with long-term corporate objectives.

- Investor Confidence: The participation of reputable institutional investors in QIPs enhances the credibility of the issuing company. This endorsement often leads to increased investor confidence and can positively impact the company’s stock performance.

Overview of QIP Fundraising in 2024

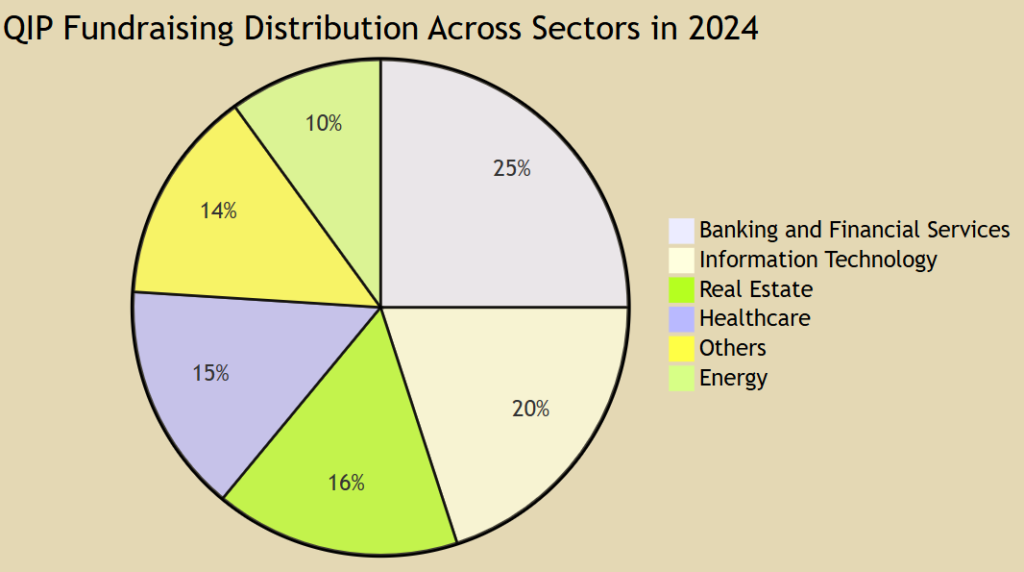

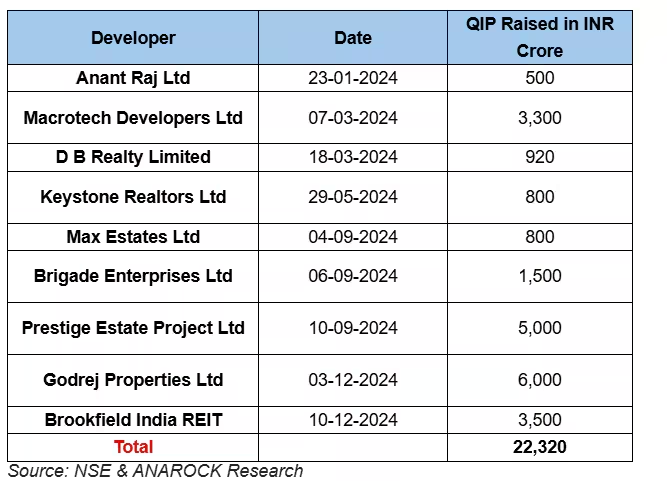

The year 2024 witnessed an unprecedented surge in QIP activities across various sectors in India. A total of 99 QIP issues culminated in a monumental ₹1,41,482 crore, marking a 75% increase from the previous record of ₹80,816 crore set in 2020. Notably, the real estate sector, encompassing both developers and Real Estate Investment Trusts (REITs), secured the largest share, with eight developers and one REIT collectively raising ₹22,320 crore.

Factors Contributing to the Surge in QIP Activities

Several key factors have been instrumental in driving the significant increase in QIP activities in 2024:

- Market Volatility and Investor Sentiment: Despite notable market corrections commencing in late September 2024, institutional investors maintained a long-term perspective, particularly within the real estate sector. This contrasts with the cautious stance adopted by retail and short-term investors during periods of volatility.

- Advantages of QIPs for Developers: QIPs offer a more expedient and cost-effective fundraising mechanism compared to traditional methods such as private equity or bank loans. They provide liquidity with minimal shareholder dilution, preserve existing ownership structures, and attract substantial capital from institutional investors, including mutual funds and pension funds. Additionally, the flexibility in fund utilization—for purposes such as land acquisition, construction, or debt refinancing—enhances financial stability and accelerates project timelines.

Comparative Analysis with Previous Years

The fundraising landscape in 2024 stands in stark contrast to prior years. In 2023, QIP fundraising across all sectors amounted to ₹55,109 crore through 43 issues, with no participation from real estate developers. The resurgence in 2024, particularly within the real estate sector, underscores a renewed institutional confidence and a strategic shift towards long-term investments in tangible assets.

Market Trends and Real Estate Performance

The broader equity market in 2024 experienced significant volatility. The Nifty 50 index performed robustly in the first half of the year, driven by strong corporate earnings, foreign institutional investment inflows, and positive economic indicators such as GDP growth and declining inflation. However, the latter half of the year was characterized by increased uncertainty due to global geopolitical tensions, fluctuating oil prices, and shifting monetary policies, leading to market corrections.

Despite these challenges, the real estate sector demonstrated remarkable resilience. The Real Estate index secured the fourth position among Nifty sectoral indices, registering an impressive 34.67% annual gain. This performance highlights the sector’s robustness and the sustained investor confidence in its growth trajectory.

QIP Investment Outlook for 2025

Looking ahead, the outlook for QIP fundraising in 2025 appears mixed, influenced by broader market volatility. The heightened fluctuations observed in the latter half of 2024 suggest a degree of caution among investors as they enter 2025. However, the strong performance of the Real Estate index, despite prevailing uncertainties, signals sustained investor confidence in the sector.

Institutional investors are anticipated to continue supporting large and listed developers, especially as they seek stable investment avenues amid broader market fluctuations. Should global monetary policies stabilize and domestic economic indicators remain strong, QIP activity in real estate may witness further momentum. This progression is expected to drive expansion, land acquisitions, and debt refinancing initiatives, thereby reinforcing the sector’s long-term growth trajectory.

Also Read: The ‘Coldplay Effect’ in Indian Real Estate: A Deep Dive into Symbolic Consumption and Its Economic Implications

The record-breaking QIP fundraising in 2024, with the real estate sector at the forefront, underscores a significant shift in investment dynamics within India’s capital markets. The resilience demonstrated by the real estate sector amidst market volatility reflects a robust institutional confidence in the country’s economic fundamentals. As we progress into 2025, the interplay between market conditions, policy frameworks, and investor sentiment will play a crucial role in shaping the trajectory of QIP activities and the broader investment landscape.

Subscribe to get updates on our latest posts and market trends.

Join The Discussion